[2024] Traditional SearchFund Model V.S SelfFunded "SearchFund"

January 09, 2024

by a searcher in Delaware, EE. UU.

I apologize in advance for whoever feels offended but...

I don´t like (AT ALL) the traditional Search Fund model, and HERE IS WHY:

The master question is:

If you find and negotiate terms in a good enough deal, do you think you will be able to raise 10 to 20 millions from private and institutional investors?

If you think yes -as i think- the question then is: but how to finance the search and how quickly you will be able to raise the acquisition capital? - Let's talk about that in a second-.

If you think no, I would like to hear from you why not in the comments below.

I bet most of you will say YES, but (intro your eloquent argument).

Here is my take:

Traditional search fund model only make sense if:

1) You need a salary, don't want to spend your savings or don´t own other income sources to finance the search.

2) You think that bringing investors early in the search will provide you more value that what it cost (equity wise).

> Nothing against a salary but, at what cost? You are leaving almost 80% of your equity in the table for 100k to 200k? And yes, i know, there are more associated cost in the search process (due diligence, legal docs, travel etc…) but i have seen that very, very expensive prices are charged to searchers from investor that bring their legal firm and defer the payment of their services in exchange for equity and promise charge the full price just in the event of a successful acquisition but man… 50k for a shareholder agreement? 100k for due diligence? - I have worked in a big law firm and done due diligence from the inside and believe me, I see that crazy prices/hours are charged to traditional searchers nowadays. Not to mention that you set-up a board since day 1 where you are in a minority position where it is “easy” to replace/fire you.

> Of course, traditional search funds (i mean, “fund of funds” investors) will not invest in your “self-funded deal”, because they have an amazing business with traditional searchers. Why invest in a much more expensive deal when they have really “cheap deals” in comparison where they can allocate capital?

For a “self-funded deal” you will need a completely different kind of investors and that's ok. Just dig your well before you're thirsty.

If I were a search fund investor, I would only invest in searchers that were able to finance his own search but approach me because they want to bring me in the journey because of my expertise in exchange for a minority position (no more than 2.5% to 5%). Just bring two or three of those people and you will have more than enough search capital for prospecting while retaining way more than 50% of your company.

Of course, you can make it work using the traditional model.

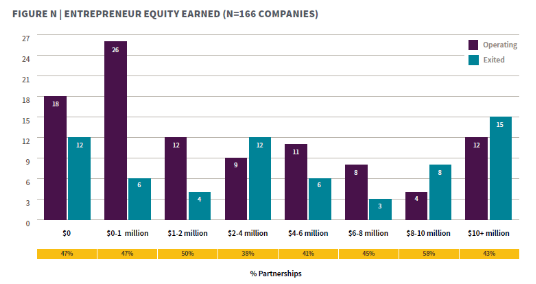

Graph 1:

Source: Stanford Business School; 2022 Search Fund Study: Selected Observations

But, remember:

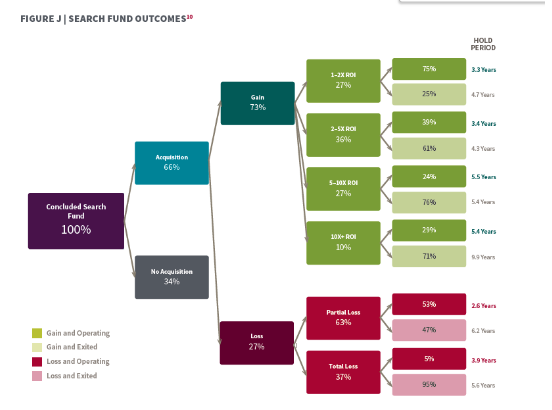

Graph 2:

This n=166 companies in graph 1 is 66%, meaning 88 search funds ended up with no acquisition. Means that from a total 254 search funds 32 make more than 4m, which means 12%. Solid. But you should also include in graph 2 the total amount of entrepreneurs trying to raise “search capital” in a traditional search fund model fashion. No data about and difficult to track but let's assume that only 1 out of 10 of tryiers will successfully achieve the “Concluded SearchFund'' stage, that means if the raise capital have an average time of 12 month that only 1% of tryers end up doing more that 4m in a 8 year period. If you add to this exit return the 200k average salary during the 8 year period you end up with an###-###-#### ,00€ average annualized income (4m in the exit and 200k average salary for 8 years). Solid. I understand why a burn-out corporate employee finds this path more attractive than keep scaling the corporate ladder.

But remember, this is just the top 1% assuming that 1 out of 10 of searchers end up with a Concluded Search Fund. The more this ecosystem grows and the more optimistic it becomes the less the success rate in concluded search funds it will be. So, I will say that this 1 out of 10 is more than 1 out of 50, or 1 out of 100. Which means that the success rate of these numbers is actually 0.1% to 0.5%. Numbers that really make sense to me seeing how nature and the world use to work.

There is no such thing like “the right way”. But my opinion is that if you can make work the traditional model you will also be capable of making work the self-funded model while optimizing your equity and your rights better.

What do you think? Let me know in the comments or shoot me a DM.

from Massachusetts Institute of Technology in Dallas, TX, USA

I decided I want to acquire a business earlier this month (you could say the seed was planted last year, but I finally decided to "water" it). I'm currently self-funded (since I just started), but I would prefer the backing of a traditional fund (or accelerator) for 1) capital and 2) resources. Currently, I could only entertain (and even then it would be tough) small(er) businesses and would need an SBA loan; however, the personal guarantee would probably require me putting my house on the line (and with a wife and toddler, that's unfeasible). (I would cash out my 401k for the right deal but I don't want to risk my family's home.) Therefore, I WELCOME giving up most of my equity; it's still a phenomenal deal- I get a potential higher salary + some equity + smaller risk. I see it as a stepping stone - upon successful exit, I now have more cash from my salary + equity (even though it's say only 20%) to buy a business only using debt, i.e. no outside investors (understanding the deals would still be smaller).

from University of Texas at Austin in Austin, TX, USA