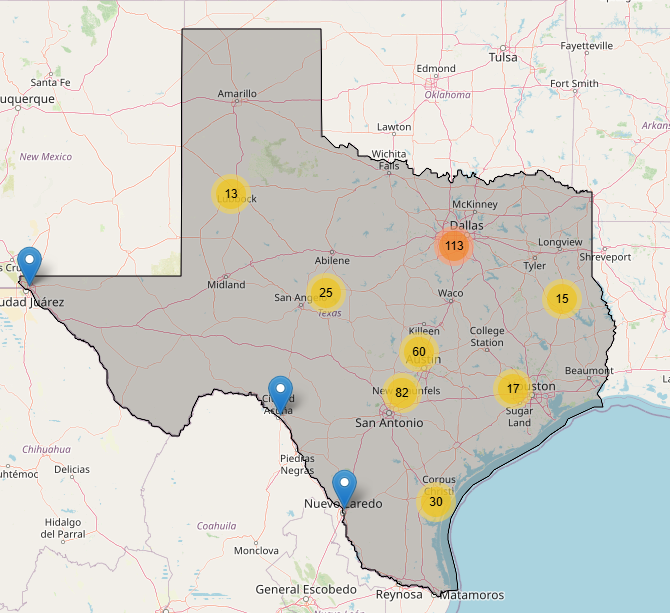

359 "off market" businesses -- TX-based home services (screenshot)

December 04, 2024

by a lender from Baylor University - Hankamer School of Business in Houston, TX, USA

Yesterday, I pulled together a short (and scrappy) prospect list of 359 "off-market" opportunities in Texas – specifically gutter cleaning and power washing businesses.

(keep reading for more info...)

3 reasons why I love these home services businesses:

- Margins: Both gutter cleaning and power washing are high margin services. I’ve seen as high as 20-50% margins depending on positioning, upsells/cross-sells, etc.

- Predictable: Both are recurring (or at least re-ocurring) revenue opportunities. With a smidge of automation, you can hook the customer once and then follow up several times a year. This means $$$$ multiples on the exit.

- Growth: Residential and commercial opportunities. You could start with wealthy homeowners (or new builds) and naturally transition to commercial properties like office building suites and apartment complexes.

I also love the simplicity of the business model (to be clear -- "simple, but not easy")...

(1) Build a prospect list of homes/businesses in your target zip codes.

(2) Run endless campaigns to engage your list.

(3) Online booking and/or schedule appointments via quick phone calls.

(4) Deliver service and bill customers.

***Very little capex. Almost no inventory. Cash flow conversion should be speedy gonzales!

But what does private equity think??

Back in December 2023, a global PE firm called Riverside Company (~$14B AUM) acquired Brothers Gutters for an undisclosed amount. Riverside flagged this deal as an "add-on" to their Evive Brands effort, which is described as a community of franchise brands in home and commercial services.

The surge in franchise M&A is real, and PE firms have been on an absolute tear over the last 24 months!

Other trends, ideas and growth triggers…

Sure, being a boots-on-the-ground service provider -- like Brothers Gutters -- is awesome, but you could also look upstream in the value chain.

For example, earlier this year, a PE firm called Audax (~$19B AUM) exited a 2019 vintage investment called ELM Home & Building Solutions, a leading provider of specialty gutters business, and manufacturer and distributor of metal roofing products.

To put it plainly: ELM sells directly to service providers like Brothers Gutters (ala “upstream).

In this case, the buyer was basically a strategic platform called Great Day Improvements, known as a vertically integrated provider of branded premium building products and residential remodeling companies. Sounds like an amazing fit!

Interesting trends & connecting the dots...

- I noticed a lot of overlap between roofing companies and gutter cleaning. Makes total sense! Something to keep in mind for post-acquisition growth strategy and tactics.

- I also noticed overlap on both the services side and building products side. For example, a company might start out as a pure bread distributor of gutters (like LeafGuard), but then wake up one day and go “wait, we should also be installing these gutters, not just selling them to service providers.”

I'd love to chat. DMs open. -- Grant

from University of Illinois at Chicago in Houston, TX, USA