Acquisition multiples for SaaS companies

October 02, 2017

by a searcher from Harvard University - Harvard Business School in Minneapolis, MN, USA

Does anyone have data points on acquisition multiples for small (i.e. sub-$3M EBITDA) SaaS companies?

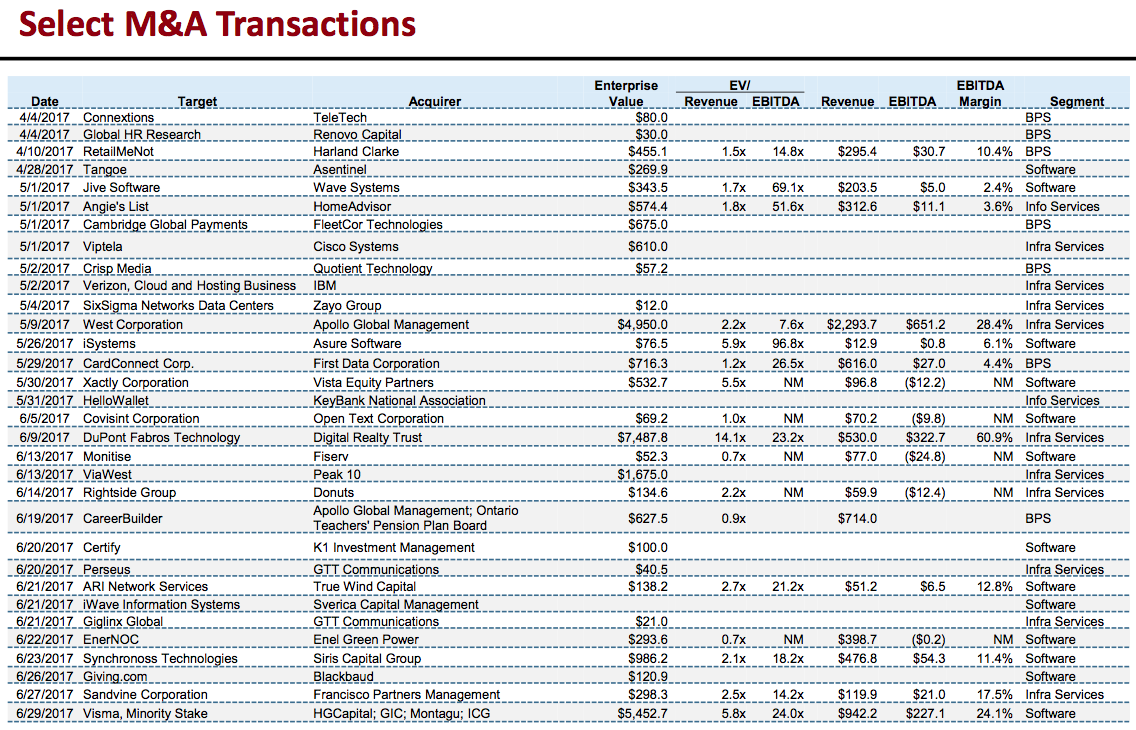

The public multiples I've come across are pretty rich (see picture), but that's to be expected. I've heard of one search fund acquisition of a smaller SaaS business management company that was 6.5x EBITDA and 2x revenue. I'd love to hear what others have seen.

from INSEAD in Amsterdam, Netherlands

from INSEAD in Paris, France