Amazon & FBA businesses EBITDA ratios

April 10, 2025

by a professional in Brooklyn, NY, USA

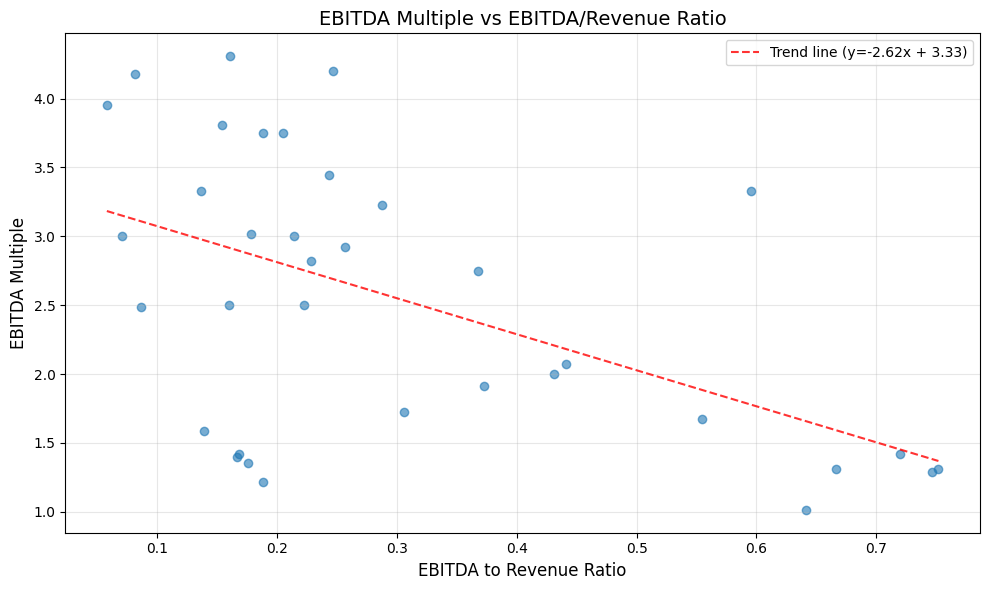

Looking at FBA & Amazon businesses' EBITDA ratios I couldn't help but notice that higher margin shops have lower ask prices relative to their EBITDA:

Why is that? Intuitively, higher-margin businesses should be more valuable and have higher ask price per EBITDA dollar.

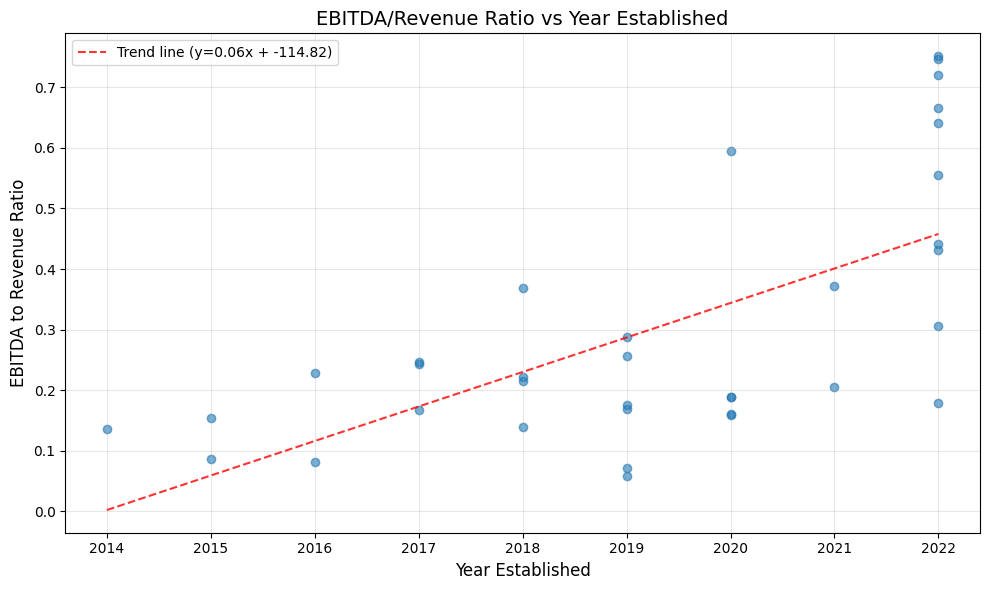

The likely explanation is tied to business stability: it becomes clear that many higher-margin businesses are newly established, which naturally introduces uncertainty about whether those margins can be maintained in the future.

We used the data from https://www.getdealmatch.com/ to power this analysis.

Curious to hear other bits of financial wisdom you came across in your search!

from New York University in Chappaqua, NY, USA

So far from my search I've found myself most interested in the older brands, 10+ years old, but they all seem to eventually get to a ~20% EBITDA margin unless there is something special like a patent + a big enough market. 20% isn't bad, of course, as long as the business is priced correctly.

from INSEAD in Boston, Massachusetts, EE. UU.