Brazil: An analysis of searchers that have, and have not, acquired

September 02, 2024

by a searcher from University of Adelaide in São Paulo, State of São Paulo, Brazil

What's your pet theory to explain why some funded searchers manage to acquire a company, and others don't? Do you have a Brazil-specific theory?

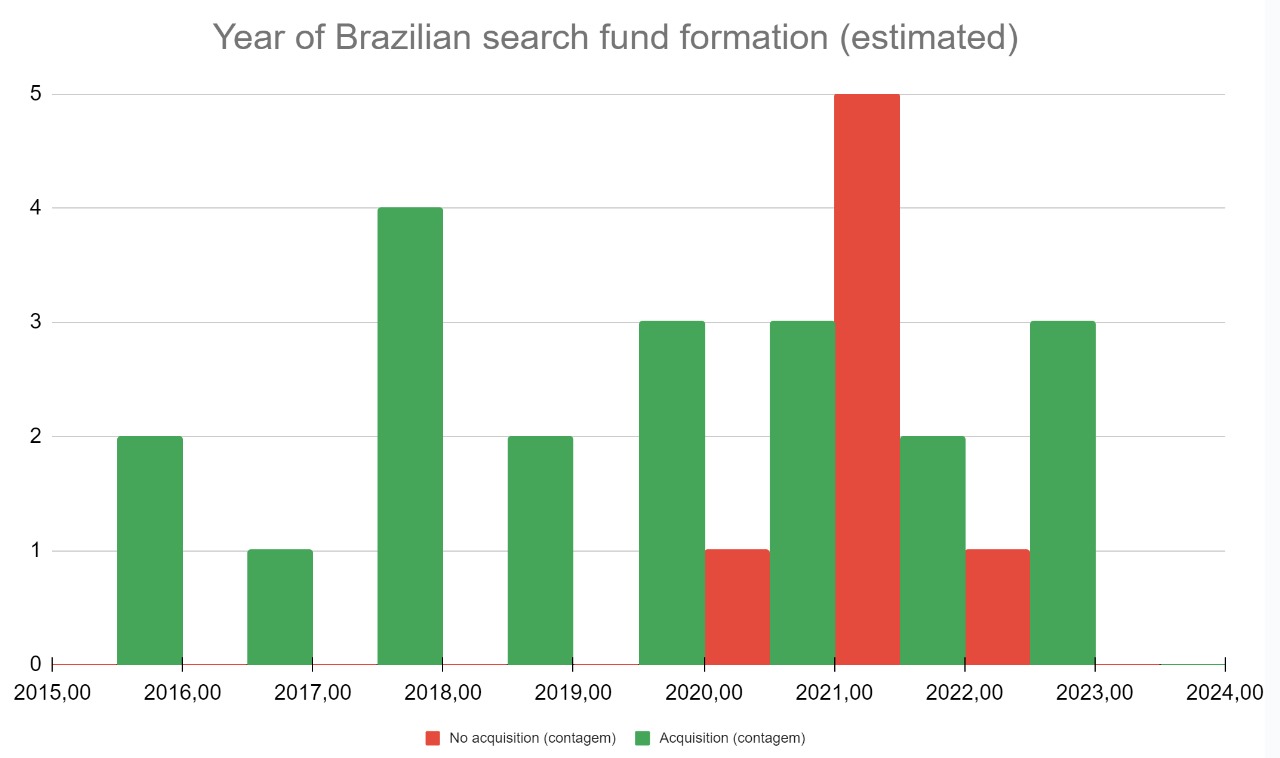

Which factor would you say best explains the very high acquisition rate (100%?) for search funds established in Brazil prior to 2020, and the sharp reduction (approx. 50%) in the cohort that launched in###-###-#### /22:

A) Pandemic effects

B) Poor searcher selection

C) Randomness (reversion to the mean is a b:tch)

D) A mix of the above

E) Something else entirely

We'd be interested to see responses in the comments, let us know if this analysis changes your priors!

Some clickbait headlines based on the data:

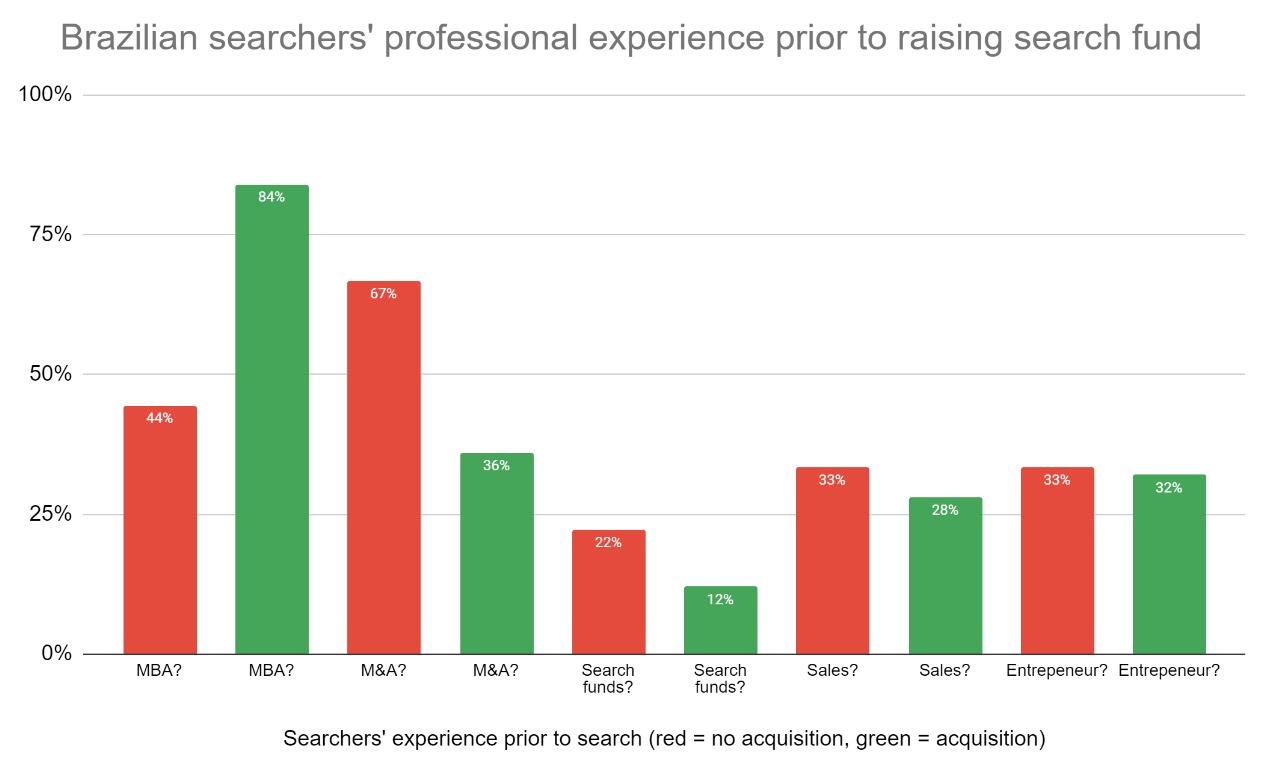

- Searchers without an MBA have rarely acquired a company in Brazil via traditional search

- Searchers with M&A or search fund specific experience, prior to raising their fund, are notably less likely to acquire than searchers without

- Searchers with Sales or Entrepreneurial experience prior to raising their fund do not gain any apparent advantage, and represent only 1/3 of searchers

- Were it not for funds launched in 2021, Brazil would still be batting at an overall 90% acquisition rate (rather than 75%)

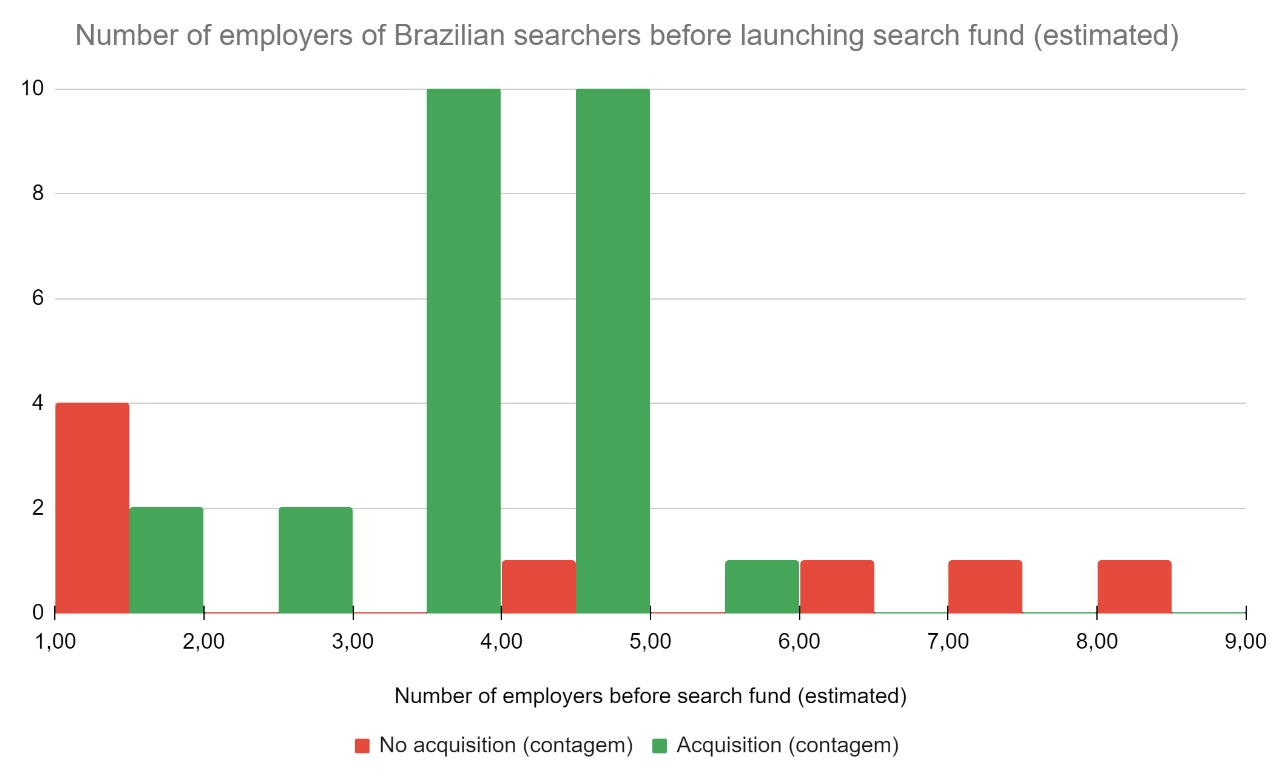

- Searchers that have acquired almost always had 3 or 4 employers prior to raising

- Searchers that have not acquired almost always had either 1 or 6-8 employers prior to raising

redacted and I have a keen interest in understanding what makes a good search fund entrepreneur. Not only are we currently raising a fund (Green & Gold Capital), but we're also potential future investors. Like any other field, there are plenty of theses. We have our own ideas, based on gut feel and grey hair. Thankfully, Brazil now has a material number of funds raised and operating beyond the traditional 2 year search phase, so we decided to generate some data and conduct a preliminary analysis. The purpose of this post is to share the initial results and invite comment, questions, challenge, etc.

Using data gathered from LinkedIn, searchfunder.com and Google, we were able to identify 20 search fund acquisitions in Brazil and 7 search funds that have conducted at least a 2 year search without acquiring. We were also able to assess the qualifications and experience of the entrepreneurs of those funds based on their LinkedIn profile, and make certain observations or estimates to allow comparison in a structured manner.

All data was collected manually and evaluated subjectively, with no independent verification. Any errors or omissions are entirely our responsibility and we apologise in advance for any defects in these initial results. Sharing them publicly is meant to help identify any such issues. This analysis should not be relied on without independently assessing its validity and relevance. The sample size is limited, and interpretation may also be time and location specific. It is challenging to obtain complete and up-to-date data, as the situation is dynamic. We hope this data is complete or close to it, but are confident it will soon be out of date if it is not already.

Disclaimers aside, we think some of the results are interesting, and may give some readers pause for thought. If nothing else, it may stimulate some interesting discussions amongst investors and with prospective entrepreneurs! ^redacted ^redacted ^redacted ^redacted ^redacted ^redacted

from University of Adelaide in São Paulo, State of São Paulo, Brazil

Looking at the data, I would not discriminate strongly on previous M&A or search fund experience, but would like to see an MBA.

I would dig deeper if the entrepreneur has only one prior employer, especially for an extended period, as well as if the entrepreneur has bounced around too frequently and shown little persistence. Both of these characteristics raise questions about the likelihood of sticking out a tough search (just as they raise questions in an employment context).

Beyond the data, there are of course other criteria I think are helpful/important.

I personally like a measure referred to as "distance travelled" by Sequoia Capital and other VC firms, for evaluating entrepreneurs. In essence, it rates people from different backgrounds by how much they've moved the needle, rather than a comparison only of the results achieved. The idea is roughly that it says less about the person, for example, for someone from a wealthy, connected background to have elite schools and modest entrepreneurial successes on their CV, than it does for someone to have overcome diverse socioeconomic disadvantages to achieve similar successes.

In the search fund context, I would also certainly look for:

- grit/tenacity/persistence, trust/integrity/transparency and negotiation/communication/persuasion as important characteristics; and

- mission/solution oriented and high-agency individuals with a bias to action.

I view analytical thinking and numerical ability as crucial, and a mix of creative-analytical-critical thinking abilities as ideal.

I would be attracted to someone with a track record dealing with the sort of public that is likely to be selling a business of interest, as well as managing the sort of public that are likely to be inherited as employees, suppliers and clients of the acquired business.

from Universidade de São Paulo in São Paulo, SP, Brasil