Cut 90% of Financial Model Review and Deal Analysis Time with Fontics

October 18, 2025

by a professional from IESE Business School in Amsterdam, Netherlands

One of the time drains in the search process is financial due diligence. Fontics changes this!

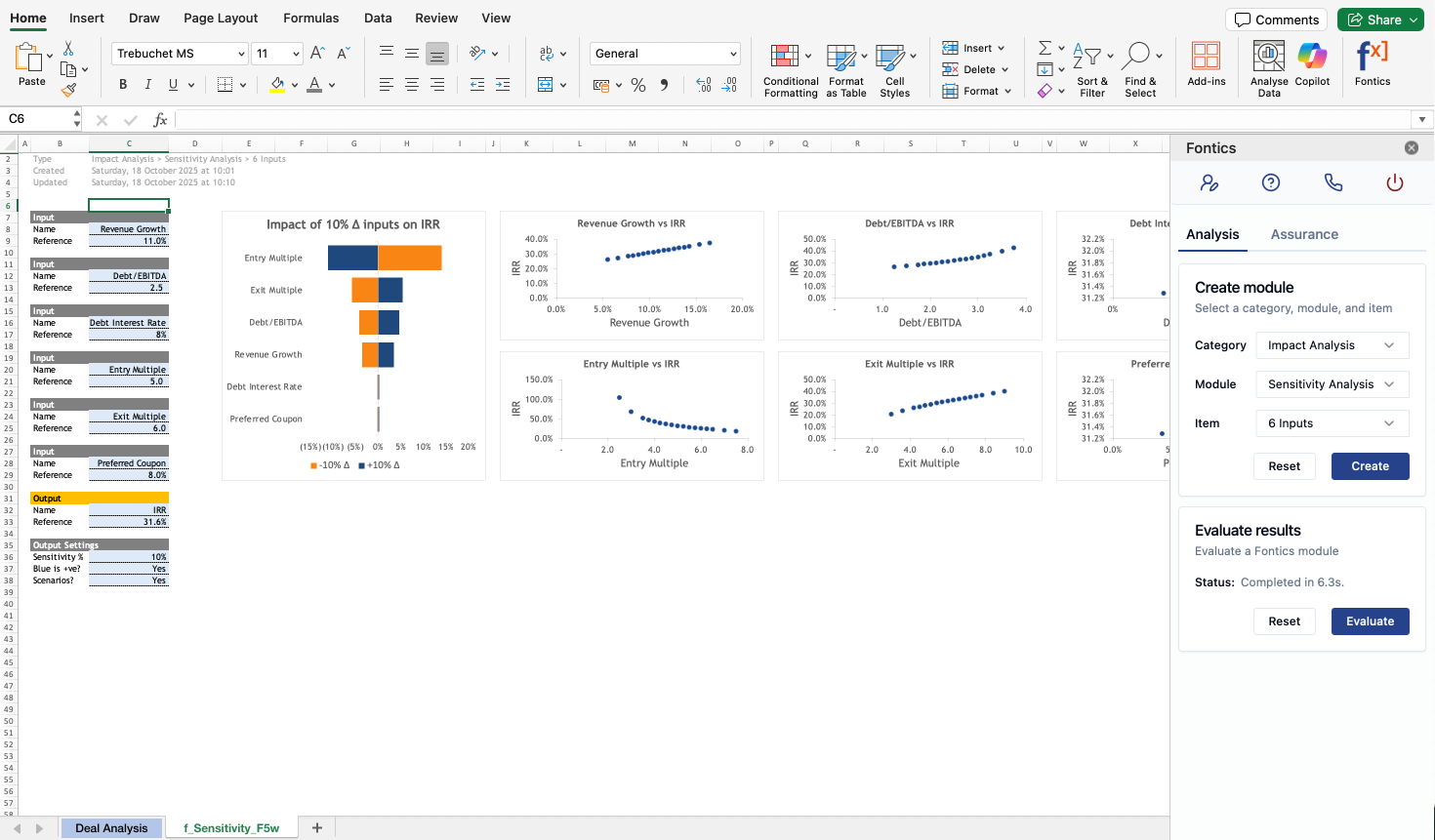

Fontics is an Excel plugin that speeds up financial model review and deal structuring by 10x. You can Review Financial Models, Run Scenarios, Sensitivity and What-If Analysis in Seconds not Hours

Features

- It integrates into any Excel model instantly. Does not use AI.

- You can change Multiples, Interest Rate and Revenue Growth etc and get the impact on IRR and MOIC in seconds

- You can backsolve drivers to evaluate what input values achieve your desired IRR and MOIC in seconds

- You can visualize models to validate the reasonableness of seller assumptions in seconds

Benefits

- For searchers: it reduces the initial review from days to hours - to find out if a deal is worth further effort or financial due diligence.

- For buy side advisors: speed up your financial due diligence, QoE etc, deal structuring advisory, increase turnaround time and support more clients.

Getting Started

It takes < 2 minutes to download and run your first analysis in Excel. You can DM if you need a 15 walk through or have any questions!

The attached is a Sensitivity + Scenario Analysis (took < 1 minute to run - all outdata data and charts are generated automatically)

Plans start at $4.99/month. Try for free at https://fontics.com

One of the time drains in the search process is financial due diligence. Fontics changes this!

Fontics is an Excel plugin that speeds up financial model review and deal structuring by 10x. You can Review Financial Models, Run Scenarios, Sensitivity and What-If Analysis in Seconds not Hours

Features

- It integrates into any Excel model instantly. Does not use AI.

- You can change Multiples, Interest Rate and Revenue Growth etc and get the impact on IRR and MOIC in seconds

- You can backsolve drivers to evaluate what input values achieve your desired IRR and MOIC in seconds

- You can visualize models to validate the reasonableness of seller assumptions in seconds

Benefits

- For searchers: it reduces the initial review from days to hours - to find out if a deal is worth further effort or financial due diligence.

- For buy side advisors: speed up your financial due diligence, QoE etc, deal structuring advisory, increase turnaround time and support more clients.

Getting Started

It takes < 2 minutes to download and run your first analysis in Excel. You can DM if you need a 15 walk through or have any questions!

The attached is a Sensitivity + Scenario Analysis (took < 1 minute to run - all outdata data and charts are generated automatically)

Plans start at $4.99/month. Try for free at https://fontics.com

from IESE Business School in Amsterdam, Netherlands

from IESE Business School in Amsterdam, Netherlands