Don’t let Net Working Capital Pegs sink your next deal

July 11, 2025

by a professional from Tulane University - A. B. Freeman School of Business in Portland, ME, USA

I see this issue on 99% of deals.

It's usually the biggest point of contention.

It almost always creates tension.

and it usually comes towards the end of a deal,

which is the most crucial time,

I've seen the issue kill many deals.

So let's talk about the Net Working Capital (NWC) peg

And how to avoid this frequent pitfall when negotiating.

The NWC peg represents two things:

1) The amount needed to operate the business without any disruption.

2) The amount the buyer assumes they are receiving at close as part of their purchase price.

The peg is under the microscope.

Why?

Because every dollar directly changes the effective purchase price.

If the Buyer is experienced,

They probably outlined a NWC peg methodology in the LOI.

But this is still usually disputed.

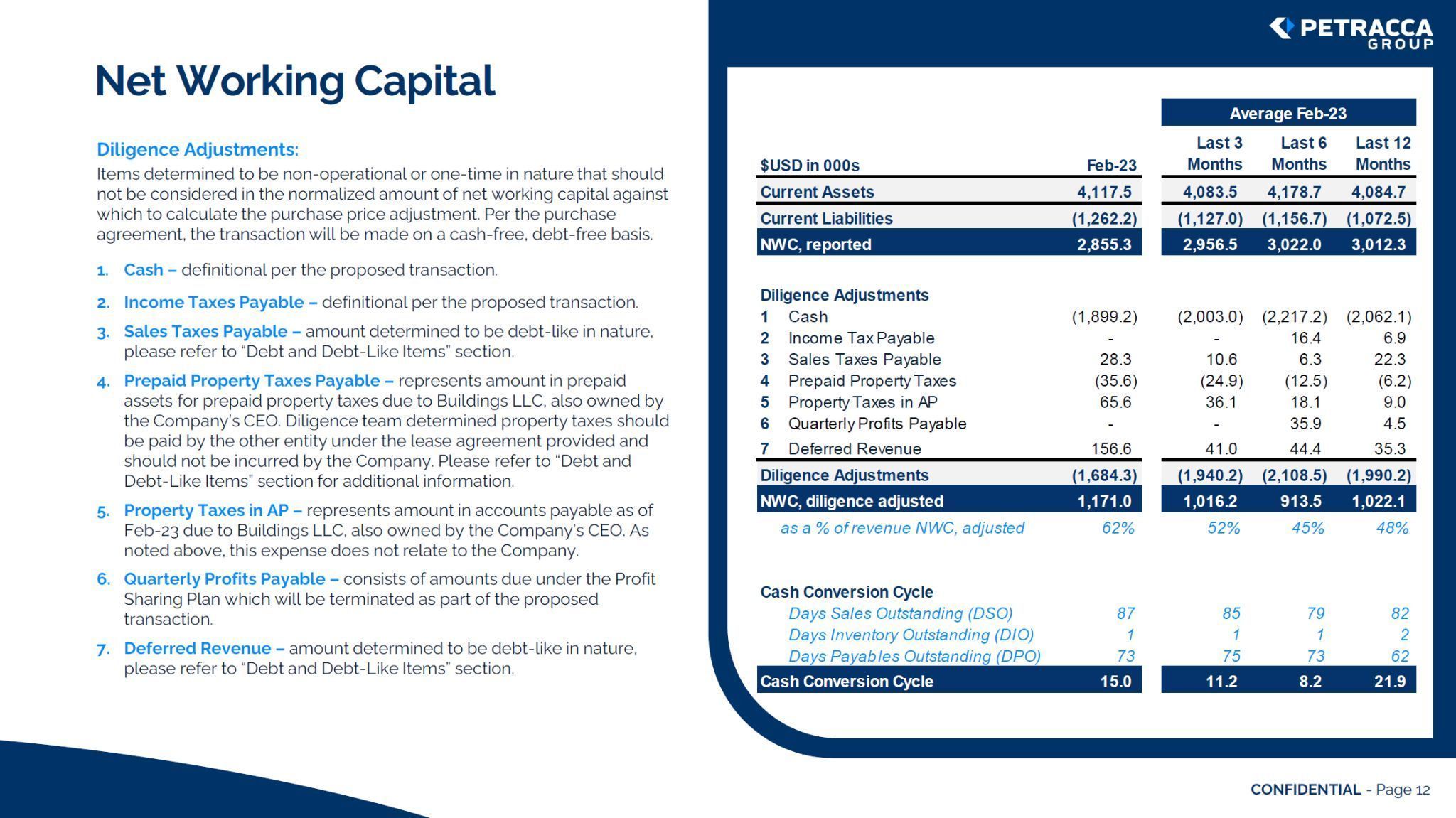

Using a methodology like the "last twelve months avg." in an LOI is a good start.

In fact, I recommend something like this.

But just like reported EBITDA,

reported NWC doesn't tell the whole story

We need to include adjustments to get to the true go-forward view.

So these adjustments need to be negotiated post-LOI.

Plus, diligence may change the buyer's perspective.

And the fun doesn't stop even after this hurdle during diligence.

After the close date, the calculation is performed again.

Specifics are often negotiated even after the calculation method

is detailed in the Purchase Agreement.

My advice?

1) Be transparent.

2) Get ahead of the conversation

3) Understand NWC like the back of your hand.

4) Put detailed definitions in the Purchase Agreement

This topic alone usually pays for my fee on a deal –

I help buyers and sellers align on the calculation.

And help my client negotiate this successfully

Without adding tension to the deal (the hardest part)

Have you had issue negotiating this in the past?

I see this issue on 99% of deals.

It's usually the biggest point of contention.

It almost always creates tension.

and it usually comes towards the end of a deal,

which is the most crucial time,

I've seen the issue kill many deals.

So let's talk about the Net Working Capital (NWC) peg

And how to avoid this frequent pitfall when negotiating.

The NWC peg represents two things:

1) The amount needed to operate the business without any disruption.

2) The amount the buyer assumes they are receiving at close as part of their purchase price.

The peg is under the microscope.

Why?

Because every dollar directly changes the effective purchase price.

If the Buyer is experienced,

They probably outlined a NWC peg methodology in the LOI.

But this is still usually disputed.

Using a methodology like the "last twelve months avg." in an LOI is a good start.

In fact, I recommend something like this.

But just like reported EBITDA,

reported NWC doesn't tell the whole story

We need to include adjustments to get to the true go-forward view.

So these adjustments need to be negotiated post-LOI.

Plus, diligence may change the buyer's perspective.

And the fun doesn't stop even after this hurdle during diligence.

After the close date, the calculation is performed again.

Specifics are often negotiated even after the calculation method

is detailed in the Purchase Agreement.

My advice?

1) Be transparent.

2) Get ahead of the conversation

3) Understand NWC like the back of your hand.

4) Put detailed definitions in the Purchase Agreement

This topic alone usually pays for my fee on a deal –

I help buyers and sellers align on the calculation.

And help my client negotiate this successfully

Without adding tension to the deal (the hardest part)

Have you had issue negotiating this in the past?