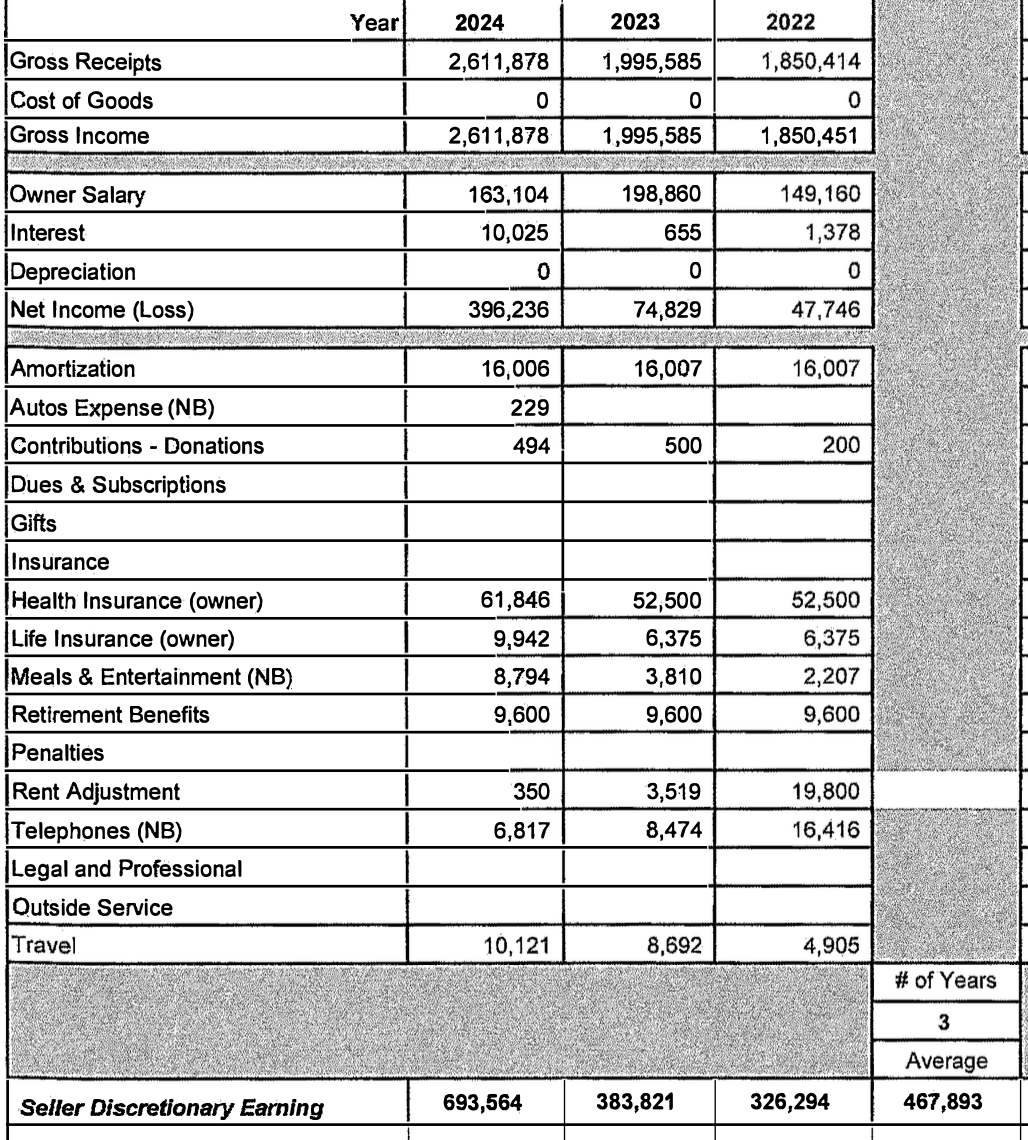

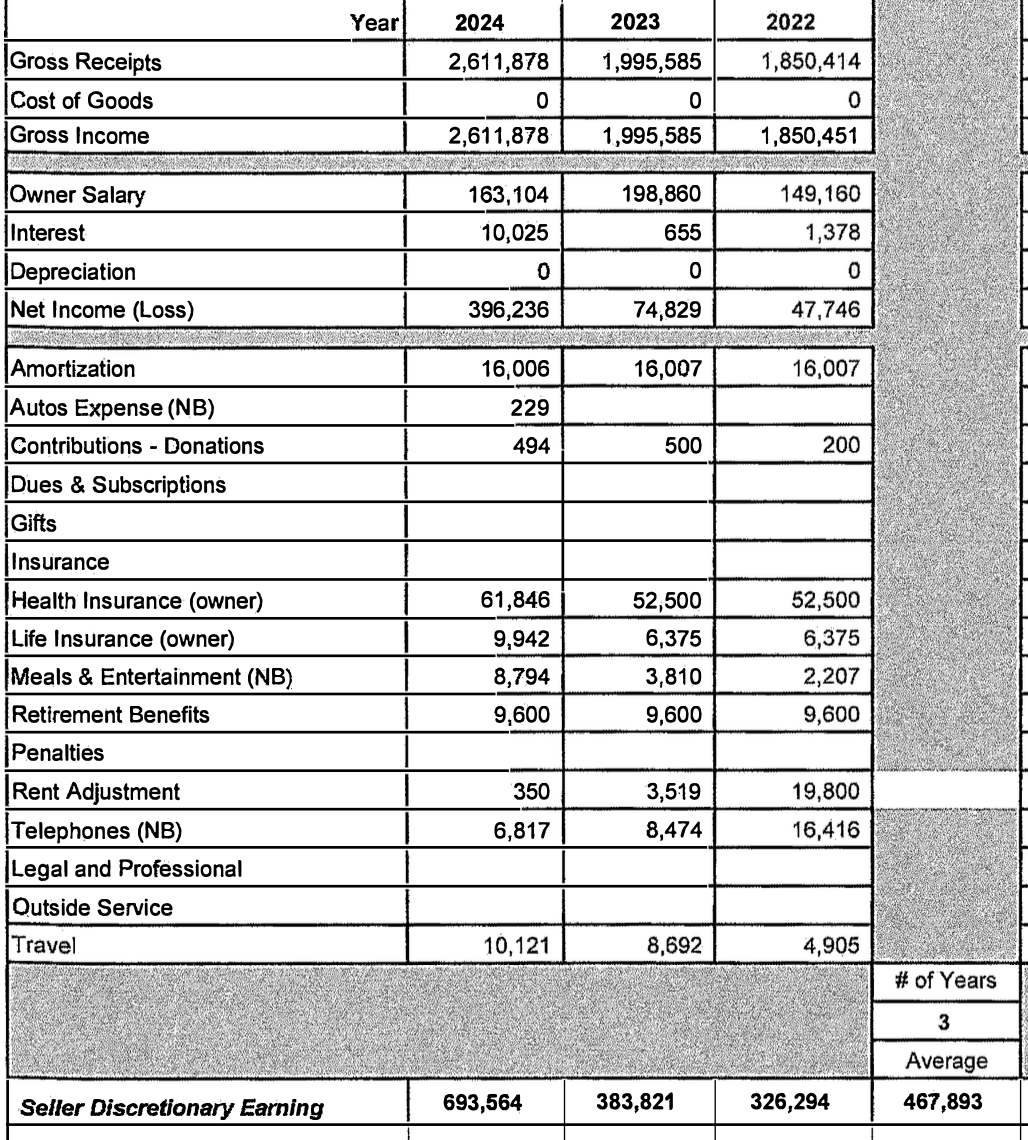

How much would you offer?

October 20, 2025

by a searcher in United States

***Additional info***

Situation Overview:

The company has 3 equal owners:

Owner A: Retired, not contributing operationally.

Owners B & C: Actively involved in daily operations.

Owner A’s spouse serves as office manager.

The 2 active owners wish to remain on payroll.

Team Composition Beyond Owners:

1 Office Manager (retired owner’s spouse)

1 Engineering Leader

4 Software Developers

1 Creative Leader

1 UX Designer

2 Customer Success Specialists

1 Sales Rep

Key Considerations:

Cash flow constraints: Paying owner salaries plus debt service may be unsustainable.

Potential friction: Owners may have differing views of how to run/grow business and might cause friction if remain involved

Potential Acquisition Structures in Mind:

1) Full Buyout + Short-Term Payroll... Buy all owners. Keep active owners and office manager on transition contracts. Reduce salaries after purchase.

2) Earnout / Deferred Compensation... Mix of upfront payment and seller note or earnout. Defer some owner compensation until business performs.

3) Buy Retired Owner Only... Purchase only the non-contributing owner’s equity. Maintain current salaries for active owners. I could get taste of business ownership while keeping my day job.

How would you proceed?

---

Additional context:

- Niche web development

- 25 years old

- 11 employees + owners

- Legacy, outdated technology in dying space but could pivot to modern tech

from Eastern Illinois University in 900 E Diehl Rd, Naperville, IL 60563, USA

from University of Pennsylvania in Los Angeles, CA, USA