How to manage LPs Influence on Acquisition Targets?

May 16, 2025

by a searcher from Vanderbilt University in Nashville, TN, USA

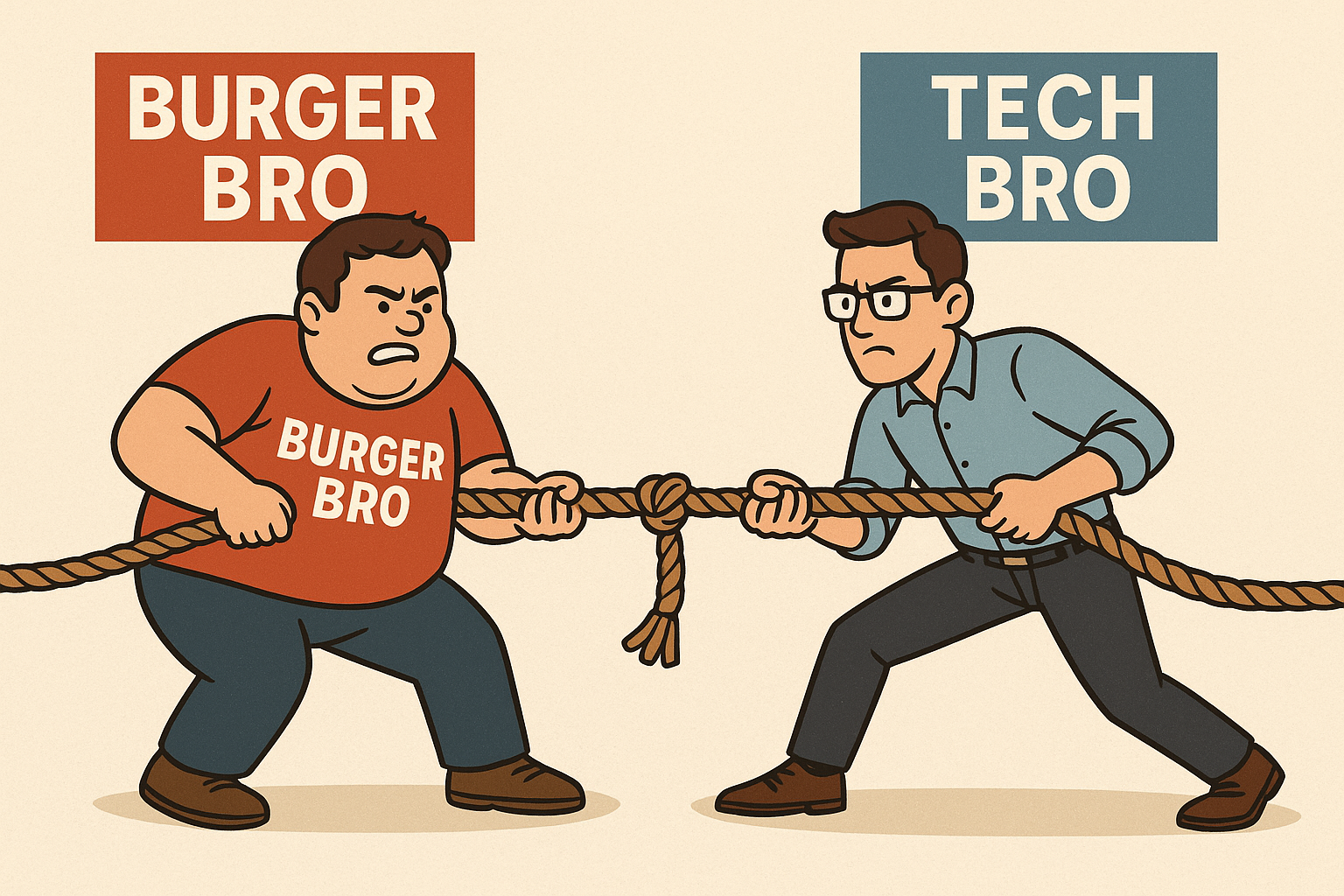

I've been passively courting investors for my eventual acquisition. One thing that has really been throwing me for a loop mentally is having investors that want to steer the acquisition to their preferred verticals.

For example, I know a SAAS-focused PE firm owner that I think would be interested in up to $200K toward a tech business like a SAAS or MSP, but he's not big on franchise retail - wants more of the bigger exit opportunity than a 1-2 unit franchise would have.

I also know a top residential real estate brokerage owner and he wants me to lean toward a home services type franchise so he can send referrals from his hundreds of house transactions that he's involved in.

I was mentored by the founder of Domino's Pizza for years while being an owner/operator - so fast food is practically in my bones. As my mentor would say about top franchisees, "he's got pizza sauce in his veins!"

My corporate background was MSP/Information Technology so I'm strong there and MSP would be a good target because not everyone can run that business, but I just plain love the fast food business.

Problem is I can't seem to align with LPs that have any interest in me slingin' pizza or burgers for our acquisition target.

I know that growing to 5+ units in QSR can bring consistent dividends for investors - how do I find those investors who are looking for more of a cash flow play than an exit play? Thoughts?

I've been passively courting investors for my eventual acquisition. One thing that has really been throwing me for a loop mentally is having investors that want to steer the acquisition to their preferred verticals.

For example, I know a SAAS-focused PE firm owner that I think would be interested in up to $200K toward a tech business like a SAAS or MSP, but he's not big on franchise retail - wants more of the bigger exit opportunity than a 1-2 unit franchise would have.

I also know a top residential real estate brokerage owner and he wants me to lean toward a home services type franchise so he can send referrals from his hundreds of house transactions that he's involved in.

I was mentored by the founder of Domino's Pizza for years while being an owner/operator - so fast food is practically in my bones. As my mentor would say about top franchisees, "he's got pizza sauce in his veins!"

My corporate background was MSP/Information Technology so I'm strong there and MSP would be a good target because not everyone can run that business, but I just plain love the fast food business.

Problem is I can't seem to align with LPs that have any interest in me slingin' pizza or burgers for our acquisition target.

I know that growing to 5+ units in QSR can bring consistent dividends for investors - how do I find those investors who are looking for more of a cash flow play than an exit play? Thoughts?

from Belmont University in Nashville, TN, USA

from Boise State University in Boise, ID, USA