Independent Sponsor Economics – How does an Independent Sponsor Make Money? (Part I of III)

May 19, 2025

by a professional from Georgetown University in Maryland, USA

An Independent Sponsor (i.e., fundless sponsor) is a private equity buyer without a permanent fund – meaning they raise debt and equity for each investment. These are complex transactions that involve significant expertise from an M&A lawyer to navigate (see https://elialbrecht.substack.com/p/m-and-a-monday-structure-and-financing?r=3btsrx), for a breakdown of the structuring of this type of deal). Today’s post focuses on how an IS’ makes money, what the market is, what is negotiable, and where I see these terms landing on my deals.

One note, I will use data from MW Independent Sponsor Survey (2023), however, I find that the sponsors I represent are getting much better terms than this survey. I have my theory as to why, but across the board, MW’s data is not sponsor-friendly.

Typically, an IS has three streams of economics, (i) Transaction Fees, (ii) Management Fees, and (iii) Carry.

(i) Transaction Fees. This is a fee resulting from the IS acquiring the platform target, each add-on acquisition, and refinancings/new capitalizations. (This is also called, Acquisition Fee or Diligence Fee.)

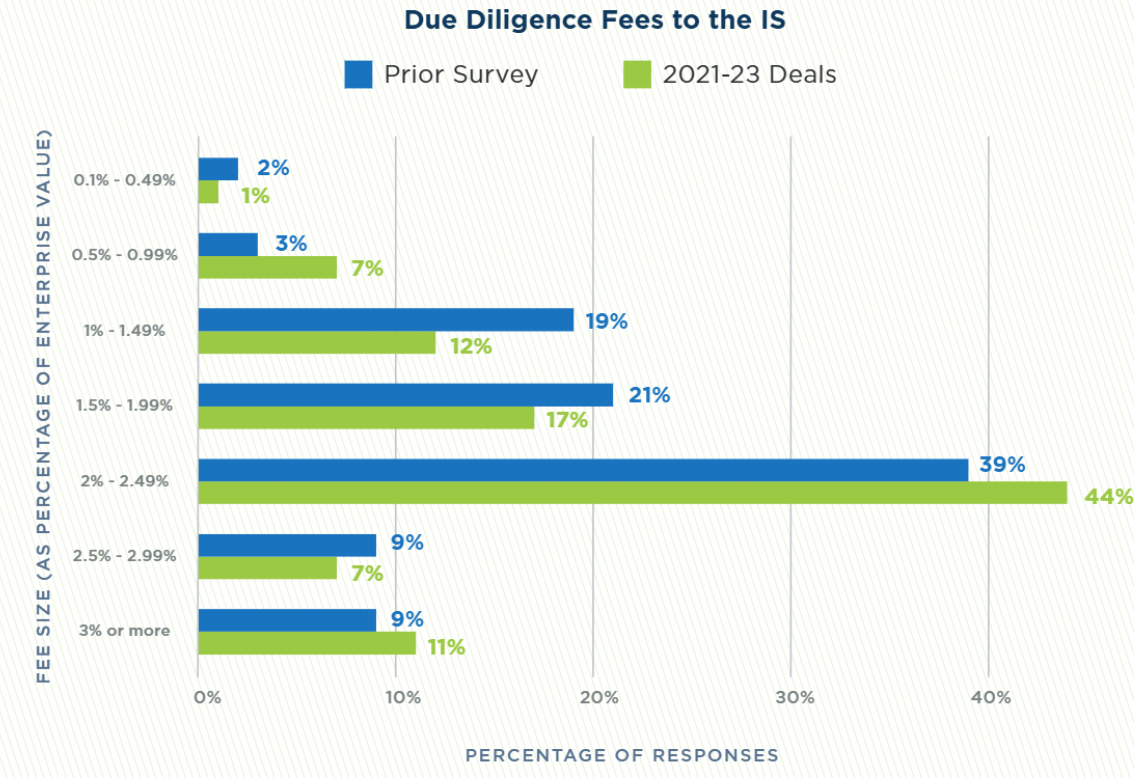

The market for Transaction Fees is around 2.5% for the initial transaction and 2.5%-3% for add-ons and financings.

An Independent Sponsor (i.e., fundless sponsor) is a private equity buyer without a permanent fund – meaning they raise debt and equity for each investment. These are complex transactions that involve significant expertise from an M&A lawyer to navigate (see https://elialbrecht.substack.com/p/m-and-a-monday-structure-and-financing?r=3btsrx), for a breakdown of the structuring of this type of deal). Today’s post focuses on how an IS’ makes money, what the market is, what is negotiable, and where I see these terms landing on my deals.

One note, I will use data from MW Independent Sponsor Survey (2023), however, I find that the sponsors I represent are getting much better terms than this survey. I have my theory as to why, but across the board, MW’s data is not sponsor-friendly.

Typically, an IS has three streams of economics, (i) Transaction Fees, (ii) Management Fees, and (iii) Carry.

(i) Transaction Fees. This is a fee resulting from the IS acquiring the platform target, each add-on acquisition, and refinancings/new capitalizations. (This is also called, Acquisition Fee or Diligence Fee.)

The market for Transaction Fees is around 2.5% for the initial transaction and 2.5%-3% for add-ons and financings.

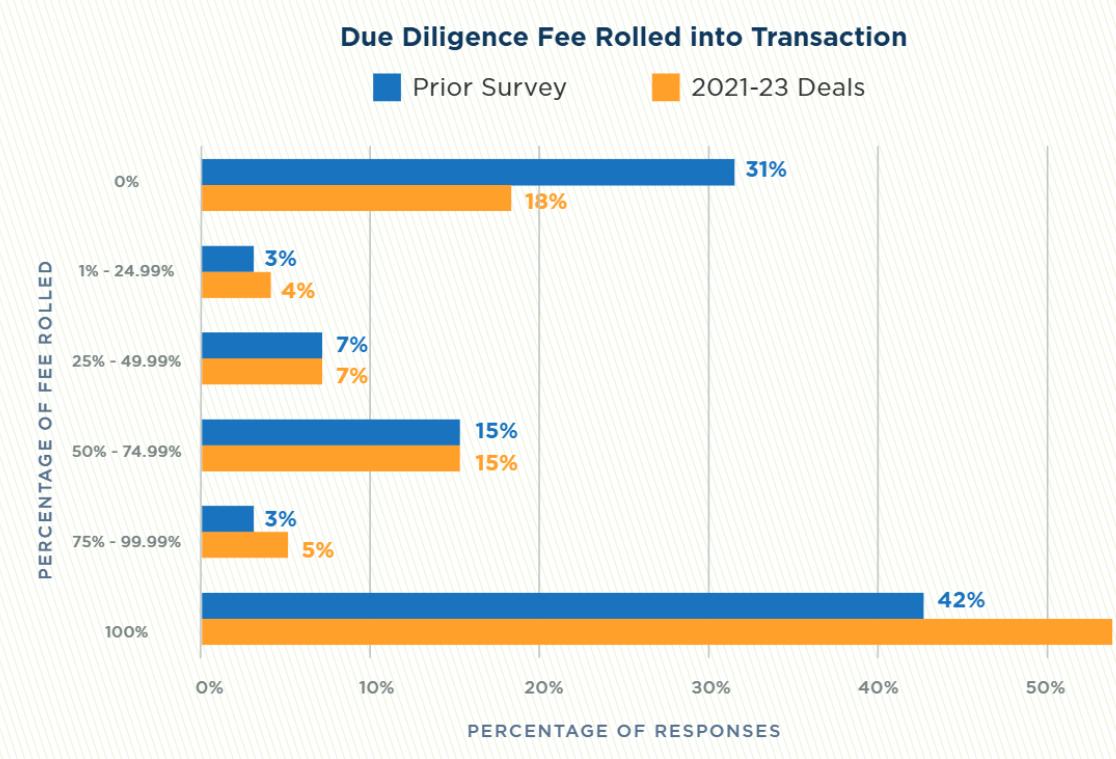

Often, an IS will be compelled to “roll” in their Transaction Fee for the initial platform acquisition. This means they do not take the transaction fee in cash at closing, rather they roll it in as the IS’ contribution to the deal. This is in exchange for preferred equity, profits interests, or on rare occasions, the Sponsor’s carry (i.e., nothing).

When IS is forced to roll the transaction fee I push hard for this to come in as preferred equity alongside other equity investors. One step down, the Transaction Fee is exchanged for profits interests, which sits below investors in the waterfall. Finally, and rarely, it is rolled into the deal in exchange for the Sponsor’s Carried Interest (see Part III).

Sometimes, part of the transaction fee is rolled and some is taken in cash. For add-ons, it is almost always taken in cash. MW survey says half of deals roll 100% of the Transaction Fee – this is not true in my deals. Only 25% of deals are forced to roll 100% of the Transaction Fee into equity, but of course, this is because I am fighting for my clients.

Often, an IS will be compelled to “roll” in their Transaction Fee for the initial platform acquisition. This means they do not take the transaction fee in cash at closing, rather they roll it in as the IS’ contribution to the deal. This is in exchange for preferred equity, profits interests, or on rare occasions, the Sponsor’s carry (i.e., nothing).

When IS is forced to roll the transaction fee I push hard for this to come in as preferred equity alongside other equity investors. One step down, the Transaction Fee is exchanged for profits interests, which sits below investors in the waterfall. Finally, and rarely, it is rolled into the deal in exchange for the Sponsor’s Carried Interest (see Part III).

Sometimes, part of the transaction fee is rolled and some is taken in cash. For add-ons, it is almost always taken in cash. MW survey says half of deals roll 100% of the Transaction Fee – this is not true in my deals. Only 25% of deals are forced to roll 100% of the Transaction Fee into equity, but of course, this is because I am fighting for my clients.

These points are heavily negotiated by lenders and professional investors. They want the acquisition fee to be lower, rolled, and rolled into nothing or profits interests.

I vigorously negotiate this with lenders and investors. I have been on calls with lenders and investors where I describe the 13 months the IS’ was working on this deal. These are people who risked everything to leave their jobs, max out credit cards, destroy relationships, are tortured by dead deals, and when they finally get to closing, they need the acquisition fee to pay off debts, and put money in the bank to prepare for the next bruising battle. Frankly, no one deserves the Transaction Fee more than them.

Comes along the lender two months before closing (who by the way has no problem taking their own fees at closing and every turn) and says, oh, don’t be greedy, roll in your fee - you should have skin in the game. The IS is practically bleeding out from one of the hardest acquisition structures in the world and the lender says, Where is your skin in the game?

Nonsense.

Sponsors should take a fee and feed their families. Lenders/Investors asking for fees to be rolled are hypocritical and rude. The IS is sufficiently motivated to grow the business to get the management fee and upside of the Carried Interest. I am happy to share who the lenders are who are totally fine with Transaction Fees and those who try to squeeze sponsors just because they can.

In Part II, I will do a deep dive into Management Fees, and in Part III, Carried Interest.

These points are heavily negotiated by lenders and professional investors. They want the acquisition fee to be lower, rolled, and rolled into nothing or profits interests.

I vigorously negotiate this with lenders and investors. I have been on calls with lenders and investors where I describe the 13 months the IS’ was working on this deal. These are people who risked everything to leave their jobs, max out credit cards, destroy relationships, are tortured by dead deals, and when they finally get to closing, they need the acquisition fee to pay off debts, and put money in the bank to prepare for the next bruising battle. Frankly, no one deserves the Transaction Fee more than them.

Comes along the lender two months before closing (who by the way has no problem taking their own fees at closing and every turn) and says, oh, don’t be greedy, roll in your fee - you should have skin in the game. The IS is practically bleeding out from one of the hardest acquisition structures in the world and the lender says, Where is your skin in the game?

Nonsense.

Sponsors should take a fee and feed their families. Lenders/Investors asking for fees to be rolled are hypocritical and rude. The IS is sufficiently motivated to grow the business to get the management fee and upside of the Carried Interest. I am happy to share who the lenders are who are totally fine with Transaction Fees and those who try to squeeze sponsors just because they can.

In Part II, I will do a deep dive into Management Fees, and in Part III, Carried Interest.

from New York University in Newport Beach, CA, USA

from Massachusetts Institute of Technology in Portland, OR, USA