Independent Sponsor Economics – How does an Independent Sponsor make money? (Part II of III)

May 26, 2025

by a professional from Georgetown University in Maryland, USA

In Part I, we covered the first way an Independent Sponsor gets paid, the Transaction Fee. In Part II, we cover (ii) the Management Fee, and (iii) Carry.

Once an acquisition by the Independent Sponsor is closed, the Management Fee begins to be paid to the Sponsor. This is a fee paid by the newly acquired operating company (OpCo) to an entity affiliated with the IS’ principals. This fee is in consideration of the IS overseeing the portfolio company, but does not include professional services provided (i.e., CFO services).

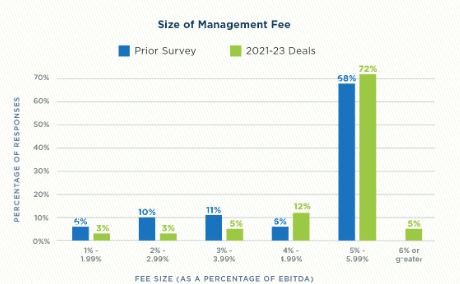

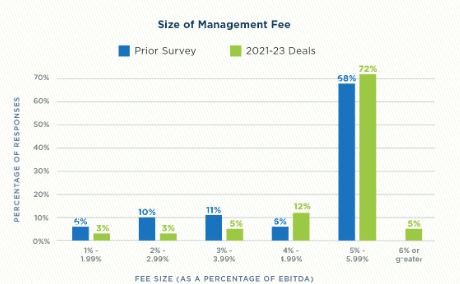

The Management Fee tends to be 5.5% of trailing 12-month EBITDA, with a floor depending on deal size, and paid quarterly (I prefer monthly). This is what the IS uses to keep their lights on.

This is done pursuant to a separate Management Agreement or Advisory Agreement.

Lenders and Investors negotiate the following points.

A. The percentage of EBITDA paid as the Management Fee. 5%-6% of EBITDA has become standard. While lenders/investors may try to negotiate this, few end up outside of 5%-6%. The fee is ordinarily paid quarterly, but I encourage clients to have it paid monthly (this is not usually controversial). The Management Fee will be frozen and (usually) accrued if subordinated by the lender (see below).

Once an acquisition by the Independent Sponsor is closed, the Management Fee begins to be paid to the Sponsor. This is a fee paid by the newly acquired operating company (OpCo) to an entity affiliated with the IS’ principals. This fee is in consideration of the IS overseeing the portfolio company, but does not include professional services provided (i.e., CFO services).

The Management Fee tends to be 5.5% of trailing 12-month EBITDA, with a floor depending on deal size, and paid quarterly (I prefer monthly). This is what the IS uses to keep their lights on.

This is done pursuant to a separate Management Agreement or Advisory Agreement.

Lenders and Investors negotiate the following points.

A. The percentage of EBITDA paid as the Management Fee. 5%-6% of EBITDA has become standard. While lenders/investors may try to negotiate this, few end up outside of 5%-6%. The fee is ordinarily paid quarterly, but I encourage clients to have it paid monthly (this is not usually controversial). The Management Fee will be frozen and (usually) accrued if subordinated by the lender (see below).

B. Trailing EBIDTA. Often, I try to get the Management Fee paid on pro-forma budgeted EBITDA. To be honest, I rarely win this point for obvious reasons.

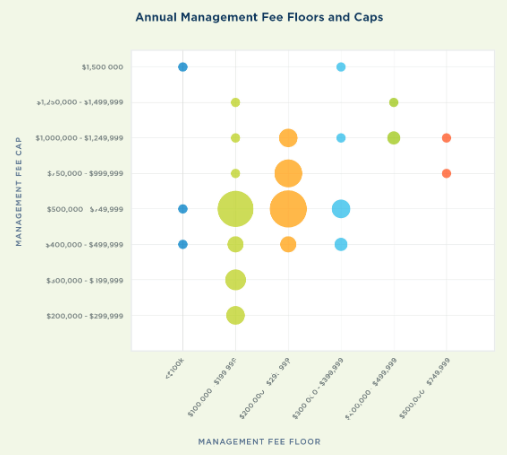

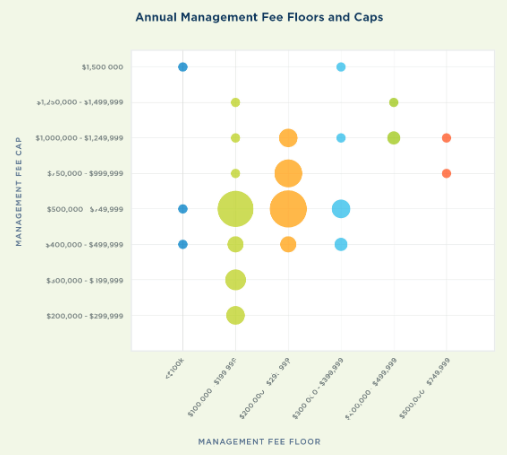

C. Floors and Ceilings. The IS will want a Management Fee floor (even if the business declines the IS will receive a certain amount of management fee) and Lender/Investor may argue against this. On a $2m-$4m business, the floor is usually $250k/$300k. The Lender/Investors may want a ceiling. For example, even if 5% of EBITDA exceeds $750k, the Management Fee is capped at $750k. I argue against a cap because it misaligns incentives for IS to grow the business. If the IS can grow the business so much to hit the ceiling, that should make everyone happy. I often see floors, but almost never agree to caps. I win this point on most deals.

B. Trailing EBIDTA. Often, I try to get the Management Fee paid on pro-forma budgeted EBITDA. To be honest, I rarely win this point for obvious reasons.

C. Floors and Ceilings. The IS will want a Management Fee floor (even if the business declines the IS will receive a certain amount of management fee) and Lender/Investor may argue against this. On a $2m-$4m business, the floor is usually $250k/$300k. The Lender/Investors may want a ceiling. For example, even if 5% of EBITDA exceeds $750k, the Management Fee is capped at $750k. I argue against a cap because it misaligns incentives for IS to grow the business. If the IS can grow the business so much to hit the ceiling, that should make everyone happy. I often see floors, but almost never agree to caps. I win this point on most deals.

D. Management Fee Subordination. The Lender will have a Management Fee Subordination Agreement to freeze the Management Fee from being paid to the IS in the event the business is not doing well and trips their covenants. The trigger and whether the fees accrue are heavily negotiated. I argue for the Management Fee to be accrued and paid out when the business is back out of default. The Lender will want the fee to be lost if frozen. Lots of options and compromises exist here. This agreement must be closely scrutinized and negotiated.

A few additional points.

1. The mechanics of the Management Fee are included in a Management Fee Agreement or Advisory Agreement. This agreement is an agreement between the OpCo and the Sponsor and includes a lot more provisions, including term, indemnification, and dispute resolution.

2. The IS should use the same ManagementCo entity for all of their platform acquisitions (i.e., the same entity receives management fees from multiple platforms) because eventually, a stake in this entity can be sold to a private equity group (or taken public). This is called a GP Stakes Acquisition and while more common in real estate and PE, can be done with an IS seeking liquidity or an exit.

3. On rare occasions, the investors/lenders are also paid a management fee. While this is rare, this is a tool that can be used if particularly in need of capital.

4. Finally, the Management Fee usually cannot be changed without lender and investor's consent. This is because the loan documents prohibit it, and the operating agreement/shareholder agreement usually prohibits the IS from engaging in affiliated agreements without the majority of investors’ consent (sometimes a different threshold). The lender’s negotiations should take place in the Management Fee Subordination Agreement because the Management Fee Agreement cannot be changed even after the lender is paid off. Lenders like to negotiate both documents, it should be resisted.

Part III will cover the third way an Independent Sponsor makes money, Carried Interest. This is the IS’ biggest upside and the most complex of the three buckets.

D. Management Fee Subordination. The Lender will have a Management Fee Subordination Agreement to freeze the Management Fee from being paid to the IS in the event the business is not doing well and trips their covenants. The trigger and whether the fees accrue are heavily negotiated. I argue for the Management Fee to be accrued and paid out when the business is back out of default. The Lender will want the fee to be lost if frozen. Lots of options and compromises exist here. This agreement must be closely scrutinized and negotiated.

A few additional points.

1. The mechanics of the Management Fee are included in a Management Fee Agreement or Advisory Agreement. This agreement is an agreement between the OpCo and the Sponsor and includes a lot more provisions, including term, indemnification, and dispute resolution.

2. The IS should use the same ManagementCo entity for all of their platform acquisitions (i.e., the same entity receives management fees from multiple platforms) because eventually, a stake in this entity can be sold to a private equity group (or taken public). This is called a GP Stakes Acquisition and while more common in real estate and PE, can be done with an IS seeking liquidity or an exit.

3. On rare occasions, the investors/lenders are also paid a management fee. While this is rare, this is a tool that can be used if particularly in need of capital.

4. Finally, the Management Fee usually cannot be changed without lender and investor's consent. This is because the loan documents prohibit it, and the operating agreement/shareholder agreement usually prohibits the IS from engaging in affiliated agreements without the majority of investors’ consent (sometimes a different threshold). The lender’s negotiations should take place in the Management Fee Subordination Agreement because the Management Fee Agreement cannot be changed even after the lender is paid off. Lenders like to negotiate both documents, it should be resisted.

Part III will cover the third way an Independent Sponsor makes money, Carried Interest. This is the IS’ biggest upside and the most complex of the three buckets.

Once an acquisition by the Independent Sponsor is closed, the Management Fee begins to be paid to the Sponsor. This is a fee paid by the newly acquired operating company (OpCo) to an entity affiliated with the IS’ principals. This fee is in consideration of the IS overseeing the portfolio company, but does not include professional services provided (i.e., CFO services).

The Management Fee tends to be 5.5% of trailing 12-month EBITDA, with a floor depending on deal size, and paid quarterly (I prefer monthly). This is what the IS uses to keep their lights on.

This is done pursuant to a separate Management Agreement or Advisory Agreement.

Lenders and Investors negotiate the following points.

A. The percentage of EBITDA paid as the Management Fee. 5%-6% of EBITDA has become standard. While lenders/investors may try to negotiate this, few end up outside of 5%-6%. The fee is ordinarily paid quarterly, but I encourage clients to have it paid monthly (this is not usually controversial). The Management Fee will be frozen and (usually) accrued if subordinated by the lender (see below).

Once an acquisition by the Independent Sponsor is closed, the Management Fee begins to be paid to the Sponsor. This is a fee paid by the newly acquired operating company (OpCo) to an entity affiliated with the IS’ principals. This fee is in consideration of the IS overseeing the portfolio company, but does not include professional services provided (i.e., CFO services).

The Management Fee tends to be 5.5% of trailing 12-month EBITDA, with a floor depending on deal size, and paid quarterly (I prefer monthly). This is what the IS uses to keep their lights on.

This is done pursuant to a separate Management Agreement or Advisory Agreement.

Lenders and Investors negotiate the following points.

A. The percentage of EBITDA paid as the Management Fee. 5%-6% of EBITDA has become standard. While lenders/investors may try to negotiate this, few end up outside of 5%-6%. The fee is ordinarily paid quarterly, but I encourage clients to have it paid monthly (this is not usually controversial). The Management Fee will be frozen and (usually) accrued if subordinated by the lender (see below).

B. Trailing EBIDTA. Often, I try to get the Management Fee paid on pro-forma budgeted EBITDA. To be honest, I rarely win this point for obvious reasons.

C. Floors and Ceilings. The IS will want a Management Fee floor (even if the business declines the IS will receive a certain amount of management fee) and Lender/Investor may argue against this. On a $2m-$4m business, the floor is usually $250k/$300k. The Lender/Investors may want a ceiling. For example, even if 5% of EBITDA exceeds $750k, the Management Fee is capped at $750k. I argue against a cap because it misaligns incentives for IS to grow the business. If the IS can grow the business so much to hit the ceiling, that should make everyone happy. I often see floors, but almost never agree to caps. I win this point on most deals.

B. Trailing EBIDTA. Often, I try to get the Management Fee paid on pro-forma budgeted EBITDA. To be honest, I rarely win this point for obvious reasons.

C. Floors and Ceilings. The IS will want a Management Fee floor (even if the business declines the IS will receive a certain amount of management fee) and Lender/Investor may argue against this. On a $2m-$4m business, the floor is usually $250k/$300k. The Lender/Investors may want a ceiling. For example, even if 5% of EBITDA exceeds $750k, the Management Fee is capped at $750k. I argue against a cap because it misaligns incentives for IS to grow the business. If the IS can grow the business so much to hit the ceiling, that should make everyone happy. I often see floors, but almost never agree to caps. I win this point on most deals.

D. Management Fee Subordination. The Lender will have a Management Fee Subordination Agreement to freeze the Management Fee from being paid to the IS in the event the business is not doing well and trips their covenants. The trigger and whether the fees accrue are heavily negotiated. I argue for the Management Fee to be accrued and paid out when the business is back out of default. The Lender will want the fee to be lost if frozen. Lots of options and compromises exist here. This agreement must be closely scrutinized and negotiated.

A few additional points.

1. The mechanics of the Management Fee are included in a Management Fee Agreement or Advisory Agreement. This agreement is an agreement between the OpCo and the Sponsor and includes a lot more provisions, including term, indemnification, and dispute resolution.

2. The IS should use the same ManagementCo entity for all of their platform acquisitions (i.e., the same entity receives management fees from multiple platforms) because eventually, a stake in this entity can be sold to a private equity group (or taken public). This is called a GP Stakes Acquisition and while more common in real estate and PE, can be done with an IS seeking liquidity or an exit.

3. On rare occasions, the investors/lenders are also paid a management fee. While this is rare, this is a tool that can be used if particularly in need of capital.

4. Finally, the Management Fee usually cannot be changed without lender and investor's consent. This is because the loan documents prohibit it, and the operating agreement/shareholder agreement usually prohibits the IS from engaging in affiliated agreements without the majority of investors’ consent (sometimes a different threshold). The lender’s negotiations should take place in the Management Fee Subordination Agreement because the Management Fee Agreement cannot be changed even after the lender is paid off. Lenders like to negotiate both documents, it should be resisted.

Part III will cover the third way an Independent Sponsor makes money, Carried Interest. This is the IS’ biggest upside and the most complex of the three buckets.

D. Management Fee Subordination. The Lender will have a Management Fee Subordination Agreement to freeze the Management Fee from being paid to the IS in the event the business is not doing well and trips their covenants. The trigger and whether the fees accrue are heavily negotiated. I argue for the Management Fee to be accrued and paid out when the business is back out of default. The Lender will want the fee to be lost if frozen. Lots of options and compromises exist here. This agreement must be closely scrutinized and negotiated.

A few additional points.

1. The mechanics of the Management Fee are included in a Management Fee Agreement or Advisory Agreement. This agreement is an agreement between the OpCo and the Sponsor and includes a lot more provisions, including term, indemnification, and dispute resolution.

2. The IS should use the same ManagementCo entity for all of their platform acquisitions (i.e., the same entity receives management fees from multiple platforms) because eventually, a stake in this entity can be sold to a private equity group (or taken public). This is called a GP Stakes Acquisition and while more common in real estate and PE, can be done with an IS seeking liquidity or an exit.

3. On rare occasions, the investors/lenders are also paid a management fee. While this is rare, this is a tool that can be used if particularly in need of capital.

4. Finally, the Management Fee usually cannot be changed without lender and investor's consent. This is because the loan documents prohibit it, and the operating agreement/shareholder agreement usually prohibits the IS from engaging in affiliated agreements without the majority of investors’ consent (sometimes a different threshold). The lender’s negotiations should take place in the Management Fee Subordination Agreement because the Management Fee Agreement cannot be changed even after the lender is paid off. Lenders like to negotiate both documents, it should be resisted.

Part III will cover the third way an Independent Sponsor makes money, Carried Interest. This is the IS’ biggest upside and the most complex of the three buckets.

in Boston, MA, USA