Jamestown Research: How We Evaluate LBO Models Realistically — Not Optimistically

May 06, 2025

by an investor from Northwestern University in Boulder, CO, USA

At Jamestown Capital, we spend a lot of time evaluating LBO models—and we’ve noticed a recurring issue: assumptions that are too optimistic, especially around future EBITDA growth.

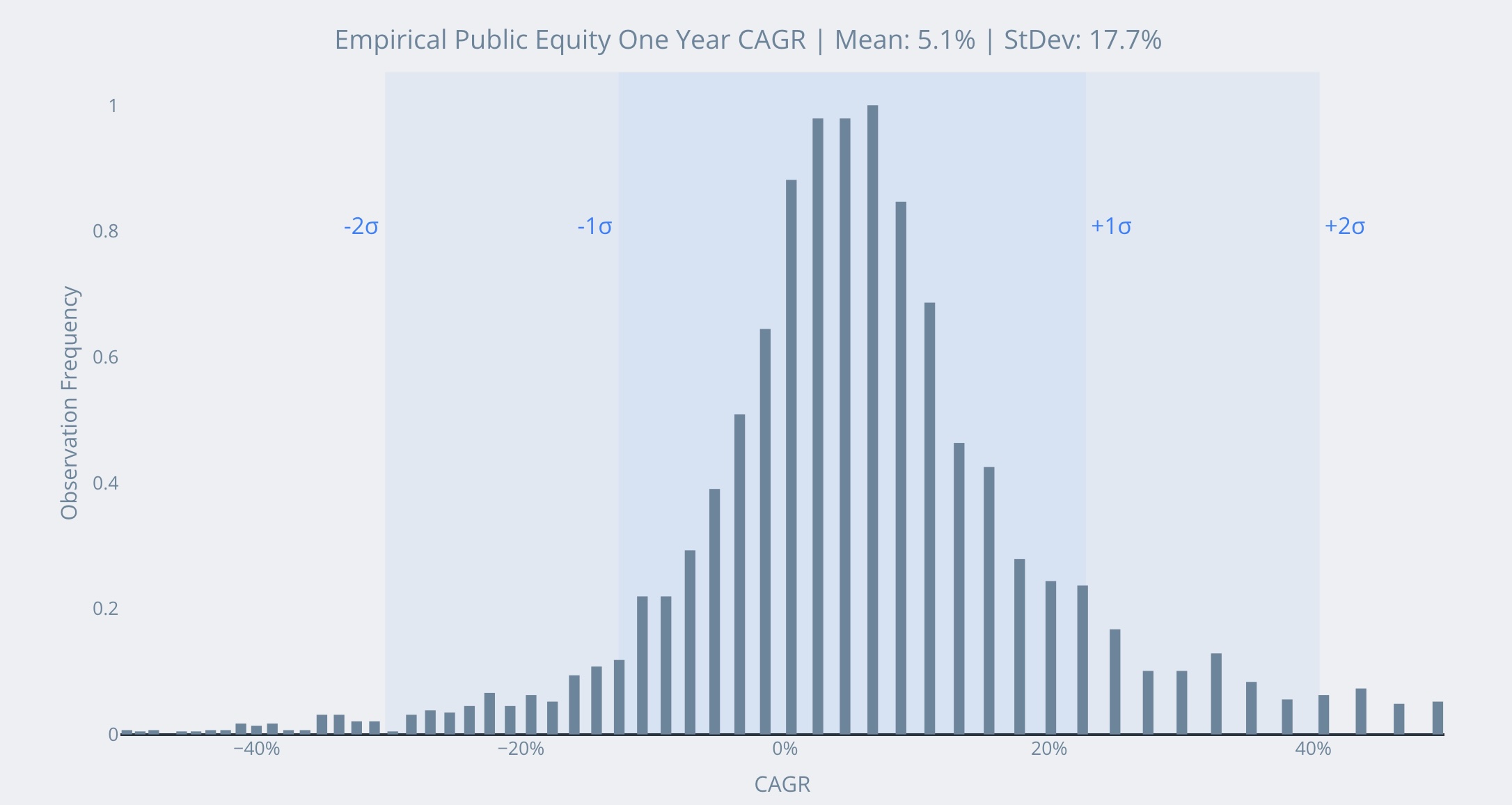

In our latest article, "Building Realistic LBO Models," we walk through how we assess these models more rigorously. By comparing assumptions to actual public equity performance, we identify when projections are detached from reality—and where risk is being underestimated.

If you’re an searcher or investor, our approach offers a framework for spotting aggressive modeling and stress-testing projections before capital is at risk.

Read the full article here: https://tinyurl.com/ycw4z2d7

At Jamestown Capital, we spend a lot of time evaluating LBO models—and we’ve noticed a recurring issue: assumptions that are too optimistic, especially around future EBITDA growth.

In our latest article, "Building Realistic LBO Models," we walk through how we assess these models more rigorously. By comparing assumptions to actual public equity performance, we identify when projections are detached from reality—and where risk is being underestimated.

If you’re an searcher or investor, our approach offers a framework for spotting aggressive modeling and stress-testing projections before capital is at risk.

Read the full article here: https://tinyurl.com/ycw4z2d7

in Austin, TX, USA

from University of Illinois at Urbana in Austin, TX, USA