Loan Structuring Financial Model

February 08, 2023

by a searcher in Salt Lake City, UT, USA

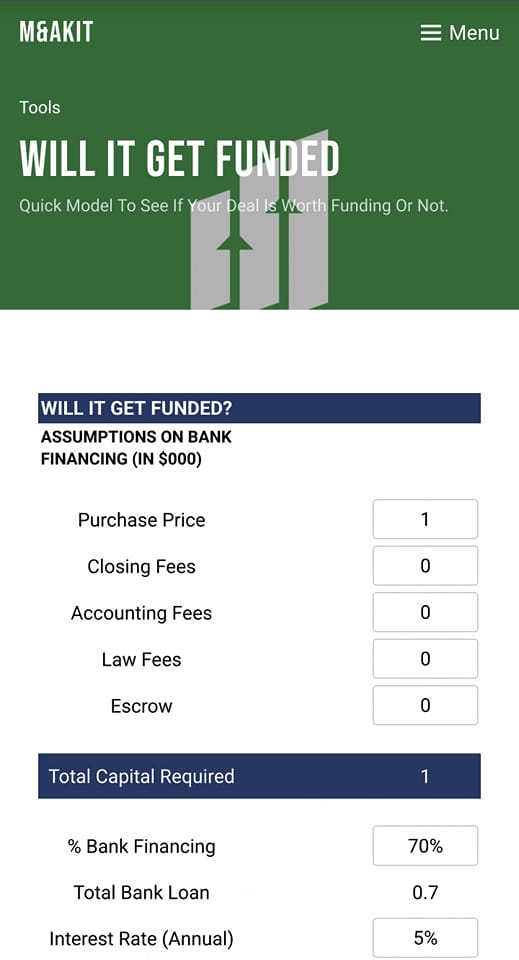

I've noticed a lot of individuals requesting feedback on various deal/loan structures. So I created this loan calculator that takes into account bank and seller finance also provides you your return on investment and purchase multiple.

This will show you if your deal is worth funding or you are depleting the business cash flows.

Rule of thumb: Your combined bank and seller debt DSCR should be 1.75x and above, anything else and you don't have much room for error/growth.

Feel free to provide any feedback, or upgrades you would like me to make.

Loan Structuring Model <--- Click this link to access.