M&A Monday - How Does an Independent Sponsor Make Money? (Part III of III)

June 23, 2025

by a professional from Georgetown University in Maryland, USA

Part III - Carried Interest

This M&A Monday post is Part III and will cover the third way an Independent Sponsor makes money, Carried Interest. This is the IS’ most significant upside and the most complex of the three buckets.

In Part I, we covered the first way an Independent Sponsor gets paid, the Transaction Fee. In Part II, we covered the Management Fee, and in Part III, we cover the most lucrative (and complex) part of the economics, the Carried Interest. This part also has the most variation. This post will be a high-level summary.

Traditionally, in a PE-style/Indy Sponsor acquisition, 100% of the equity of the business is allocated to those who put in real money. For example, with a $30M Purchase Price + transaction costs ($20M Senior Debt / $10M), 100% of the acquisition is owned by the $10M. $1M investment gets 10%.

In that case, where is the IS’ interest, ownership, and upside?

Of course, they get a management fee (see Part I), and they can roll in their Transaction Fee (see Part II), but no ownership.

Enter, Carried Interest.

Carried Interest is an economic share of the profits that acts like equity ownership. The Sponsor slots into the waterfall and has the right to economic profit after the Investors (called Preferred Investors because they have preference over others).

In the simplest form, after Investors receive their investment back plus a certain return on their investment (MOIC, IRR, or annual interest), then, the IS starts to receive 15%/20% of all profits.

Straight Waterfall vs. Variable Waterfall

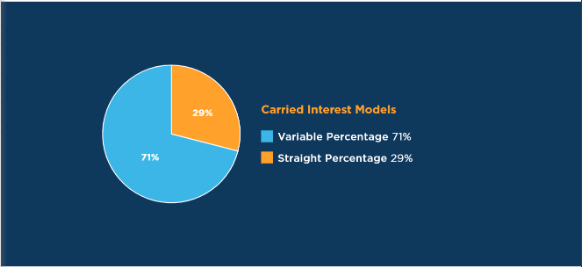

Traditionally, and most of the time, Indy Sponsors have a variable waterfall, whereby they get escalating percentages of carry the more investors make - in other words every return Hurdle, the IS gets higher percentage carry. (i.e., 15% until investors get 1.5x MOIC, 20% for a 2x MOIC, 25% for 2.5x MOIC – the numbers are all negotiable and vary). Usually, there is a catch-up included for the Sponsor.

The 2024 IS Survey says 71% are variable and 29% are straight. In my experience, this is moderately overstated.

What is Market for a variable waterfall?

More traditional IS will start at around 10%/15% for the first Hurdle of about 1.5x MOIC or 10% IRR. Second hurdle gets the IS 20% carry if the Investor gets 2x MOIC or 15% IRR. For those with a third hurdle, it is often 25% to the IS for achieving returns of 2.5x MOIC or 20% IRR plus. A catch-up for the IS is common.

Traditionally, in a PE-style/Indy Sponsor acquisition, 100% of the equity of the business is allocated to those who put in real money. For example, with a $30M Purchase Price + transaction costs ($20M Senior Debt / $10M), 100% of the acquisition is owned by the $10M. $1M investment gets 10%.

In that case, where is the IS’ interest, ownership, and upside?

Of course, they get a management fee (see Part I), and they can roll in their Transaction Fee (see Part II), but no ownership.

Enter, Carried Interest.

Carried Interest is an economic share of the profits that acts like equity ownership. The Sponsor slots into the waterfall and has the right to economic profit after the Investors (called Preferred Investors because they have preference over others).

In the simplest form, after Investors receive their investment back plus a certain return on their investment (MOIC, IRR, or annual interest), then, the IS starts to receive 15%/20% of all profits.

Straight Waterfall vs. Variable Waterfall

Traditionally, and most of the time, Indy Sponsors have a variable waterfall, whereby they get escalating percentages of carry the more investors make - in other words every return Hurdle, the IS gets higher percentage carry. (i.e., 15% until investors get 1.5x MOIC, 20% for a 2x MOIC, 25% for 2.5x MOIC – the numbers are all negotiable and vary). Usually, there is a catch-up included for the Sponsor.

The 2024 IS Survey says 71% are variable and 29% are straight. In my experience, this is moderately overstated.

What is Market for a variable waterfall?

More traditional IS will start at around 10%/15% for the first Hurdle of about 1.5x MOIC or 10% IRR. Second hurdle gets the IS 20% carry if the Investor gets 2x MOIC or 15% IRR. For those with a third hurdle, it is often 25% to the IS for achieving returns of 2.5x MOIC or 20% IRR plus. A catch-up for the IS is common.

Straight Waterfall

In a minority of Indy Sponsor deals, there is a straight waterfall. For example, Investors get their money back plus 10% annual interest, and thereafter, all profit is split 80%/20% (often, with a catch-up).

While the straight waterfall is simpler, the variable waterfall is supposed to incentivize the IS to shoot for a higher exit and reward the IS in a “home run” scenario.

What is market for straight waterfall?

In traditional IS deals, the straight waterfall tends to be around 20% - 30% carry to the IS after a return for investors of their investment plus a preferred return percentage. The 2024 Indy Sponsor Survey reflected this.

Straight Waterfall

In a minority of Indy Sponsor deals, there is a straight waterfall. For example, Investors get their money back plus 10% annual interest, and thereafter, all profit is split 80%/20% (often, with a catch-up).

While the straight waterfall is simpler, the variable waterfall is supposed to incentivize the IS to shoot for a higher exit and reward the IS in a “home run” scenario.

What is market for straight waterfall?

In traditional IS deals, the straight waterfall tends to be around 20% - 30% carry to the IS after a return for investors of their investment plus a preferred return percentage. The 2024 Indy Sponsor Survey reflected this.

However, increasingly, I am seeing higher splits. I have done 3 deals this past year where, once investors received their money back plus their percentage return, all profits were split 50/50 and 60/40 (the IS received 60). This is more common on deals where the leverage is higher, the seller holds a large promissory note and/or rollover, and the equity funds come from outside the traditional IS community. Additionally, the first return hurdle for the investor tends to be higher (i.e., 15%+ annual return)

Finally, there is a structure where lenders are putting in all of the debt and if needed, the equity (uni-tranche). While the lender usually requests warrants and the IS usually has to roll their fee into equity (see Part II), this results in the IS owning practically all of the acquisition without putting almost any of their own money in the deal. I have closed several of these deals and I will break down one of these deals in a future post.

Final note - be very careful how you structure this from a tax perspective. Your carried interest should be treated as capital gains, but we often see this messed up.

The carried interest part of the IS’ economics is the most important and the most complex. There are tons of other factors to consider, including, and importantly, tax treatment.

In the next post, I will do a deeper dive into how to finance an Indy Sponsor deal and then I will break down the structure of a recently closed Indy Sponsor deal.

However, increasingly, I am seeing higher splits. I have done 3 deals this past year where, once investors received their money back plus their percentage return, all profits were split 50/50 and 60/40 (the IS received 60). This is more common on deals where the leverage is higher, the seller holds a large promissory note and/or rollover, and the equity funds come from outside the traditional IS community. Additionally, the first return hurdle for the investor tends to be higher (i.e., 15%+ annual return)

Finally, there is a structure where lenders are putting in all of the debt and if needed, the equity (uni-tranche). While the lender usually requests warrants and the IS usually has to roll their fee into equity (see Part II), this results in the IS owning practically all of the acquisition without putting almost any of their own money in the deal. I have closed several of these deals and I will break down one of these deals in a future post.

Final note - be very careful how you structure this from a tax perspective. Your carried interest should be treated as capital gains, but we often see this messed up.

The carried interest part of the IS’ economics is the most important and the most complex. There are tons of other factors to consider, including, and importantly, tax treatment.

In the next post, I will do a deeper dive into how to finance an Indy Sponsor deal and then I will break down the structure of a recently closed Indy Sponsor deal.

Traditionally, in a PE-style/Indy Sponsor acquisition, 100% of the equity of the business is allocated to those who put in real money. For example, with a $30M Purchase Price + transaction costs ($20M Senior Debt / $10M), 100% of the acquisition is owned by the $10M. $1M investment gets 10%.

In that case, where is the IS’ interest, ownership, and upside?

Of course, they get a management fee (see Part I), and they can roll in their Transaction Fee (see Part II), but no ownership.

Enter, Carried Interest.

Carried Interest is an economic share of the profits that acts like equity ownership. The Sponsor slots into the waterfall and has the right to economic profit after the Investors (called Preferred Investors because they have preference over others).

In the simplest form, after Investors receive their investment back plus a certain return on their investment (MOIC, IRR, or annual interest), then, the IS starts to receive 15%/20% of all profits.

Straight Waterfall vs. Variable Waterfall

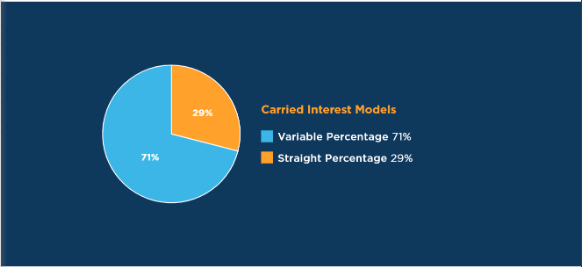

Traditionally, and most of the time, Indy Sponsors have a variable waterfall, whereby they get escalating percentages of carry the more investors make - in other words every return Hurdle, the IS gets higher percentage carry. (i.e., 15% until investors get 1.5x MOIC, 20% for a 2x MOIC, 25% for 2.5x MOIC – the numbers are all negotiable and vary). Usually, there is a catch-up included for the Sponsor.

The 2024 IS Survey says 71% are variable and 29% are straight. In my experience, this is moderately overstated.

What is Market for a variable waterfall?

More traditional IS will start at around 10%/15% for the first Hurdle of about 1.5x MOIC or 10% IRR. Second hurdle gets the IS 20% carry if the Investor gets 2x MOIC or 15% IRR. For those with a third hurdle, it is often 25% to the IS for achieving returns of 2.5x MOIC or 20% IRR plus. A catch-up for the IS is common.

Traditionally, in a PE-style/Indy Sponsor acquisition, 100% of the equity of the business is allocated to those who put in real money. For example, with a $30M Purchase Price + transaction costs ($20M Senior Debt / $10M), 100% of the acquisition is owned by the $10M. $1M investment gets 10%.

In that case, where is the IS’ interest, ownership, and upside?

Of course, they get a management fee (see Part I), and they can roll in their Transaction Fee (see Part II), but no ownership.

Enter, Carried Interest.

Carried Interest is an economic share of the profits that acts like equity ownership. The Sponsor slots into the waterfall and has the right to economic profit after the Investors (called Preferred Investors because they have preference over others).

In the simplest form, after Investors receive their investment back plus a certain return on their investment (MOIC, IRR, or annual interest), then, the IS starts to receive 15%/20% of all profits.

Straight Waterfall vs. Variable Waterfall

Traditionally, and most of the time, Indy Sponsors have a variable waterfall, whereby they get escalating percentages of carry the more investors make - in other words every return Hurdle, the IS gets higher percentage carry. (i.e., 15% until investors get 1.5x MOIC, 20% for a 2x MOIC, 25% for 2.5x MOIC – the numbers are all negotiable and vary). Usually, there is a catch-up included for the Sponsor.

The 2024 IS Survey says 71% are variable and 29% are straight. In my experience, this is moderately overstated.

What is Market for a variable waterfall?

More traditional IS will start at around 10%/15% for the first Hurdle of about 1.5x MOIC or 10% IRR. Second hurdle gets the IS 20% carry if the Investor gets 2x MOIC or 15% IRR. For those with a third hurdle, it is often 25% to the IS for achieving returns of 2.5x MOIC or 20% IRR plus. A catch-up for the IS is common.

Straight Waterfall

In a minority of Indy Sponsor deals, there is a straight waterfall. For example, Investors get their money back plus 10% annual interest, and thereafter, all profit is split 80%/20% (often, with a catch-up).

While the straight waterfall is simpler, the variable waterfall is supposed to incentivize the IS to shoot for a higher exit and reward the IS in a “home run” scenario.

What is market for straight waterfall?

In traditional IS deals, the straight waterfall tends to be around 20% - 30% carry to the IS after a return for investors of their investment plus a preferred return percentage. The 2024 Indy Sponsor Survey reflected this.

Straight Waterfall

In a minority of Indy Sponsor deals, there is a straight waterfall. For example, Investors get their money back plus 10% annual interest, and thereafter, all profit is split 80%/20% (often, with a catch-up).

While the straight waterfall is simpler, the variable waterfall is supposed to incentivize the IS to shoot for a higher exit and reward the IS in a “home run” scenario.

What is market for straight waterfall?

In traditional IS deals, the straight waterfall tends to be around 20% - 30% carry to the IS after a return for investors of their investment plus a preferred return percentage. The 2024 Indy Sponsor Survey reflected this.

However, increasingly, I am seeing higher splits. I have done 3 deals this past year where, once investors received their money back plus their percentage return, all profits were split 50/50 and 60/40 (the IS received 60). This is more common on deals where the leverage is higher, the seller holds a large promissory note and/or rollover, and the equity funds come from outside the traditional IS community. Additionally, the first return hurdle for the investor tends to be higher (i.e., 15%+ annual return)

Finally, there is a structure where lenders are putting in all of the debt and if needed, the equity (uni-tranche). While the lender usually requests warrants and the IS usually has to roll their fee into equity (see Part II), this results in the IS owning practically all of the acquisition without putting almost any of their own money in the deal. I have closed several of these deals and I will break down one of these deals in a future post.

Final note - be very careful how you structure this from a tax perspective. Your carried interest should be treated as capital gains, but we often see this messed up.

The carried interest part of the IS’ economics is the most important and the most complex. There are tons of other factors to consider, including, and importantly, tax treatment.

In the next post, I will do a deeper dive into how to finance an Indy Sponsor deal and then I will break down the structure of a recently closed Indy Sponsor deal.

However, increasingly, I am seeing higher splits. I have done 3 deals this past year where, once investors received their money back plus their percentage return, all profits were split 50/50 and 60/40 (the IS received 60). This is more common on deals where the leverage is higher, the seller holds a large promissory note and/or rollover, and the equity funds come from outside the traditional IS community. Additionally, the first return hurdle for the investor tends to be higher (i.e., 15%+ annual return)

Finally, there is a structure where lenders are putting in all of the debt and if needed, the equity (uni-tranche). While the lender usually requests warrants and the IS usually has to roll their fee into equity (see Part II), this results in the IS owning practically all of the acquisition without putting almost any of their own money in the deal. I have closed several of these deals and I will break down one of these deals in a future post.

Final note - be very careful how you structure this from a tax perspective. Your carried interest should be treated as capital gains, but we often see this messed up.

The carried interest part of the IS’ economics is the most important and the most complex. There are tons of other factors to consider, including, and importantly, tax treatment.

In the next post, I will do a deeper dive into how to finance an Indy Sponsor deal and then I will break down the structure of a recently closed Indy Sponsor deal.

from Southern Cross University in San Francisco, CA, USA

from University of California, Irvine in Laguna Hills, CA, USA