M&A Monday – Structure and Financing an Independent Sponsor Deal

April 28, 2025

by a professional from Georgetown University in Maryland, USA

This M&A Monday, we are discussing the structure and financing of an Independent Sponsor deal (called, Fundless Sponsor, or my favorite, Indy Sponsor). Indy Sponsors usually take down deals between $2m-$10m EBITDA, with some outliers. The IS can be extremely flexible, creative, and is often favored by founder-sellers. I lovingly refer to Indy Sponsors as Cashless Sponsors – they have everything except money. As such, we have developed a special legal engagement for Indy Sponsors.

Structure -

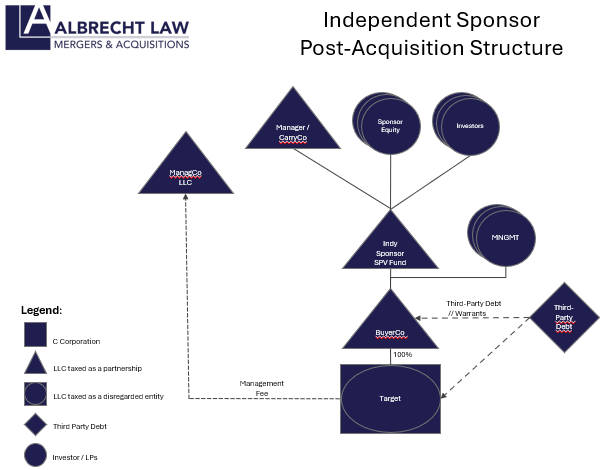

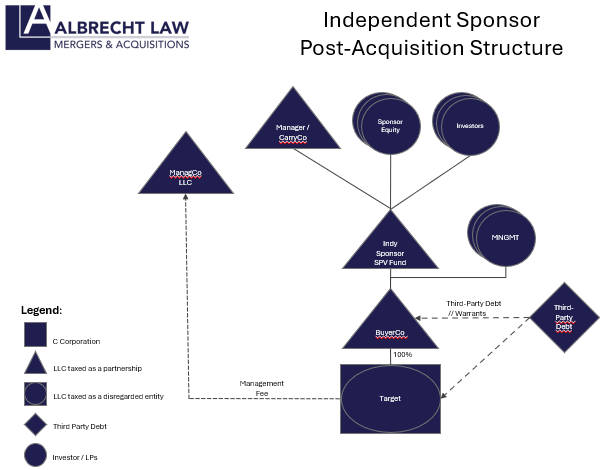

Each deal is structured with its own mini-fund. In its simplest form, the Indy Sponsor forms an SPV, that SPV takes in funds from outside investors and buys the target through a BuyerCo (see chart). (If seeking QSBS, this is different.)

Financing –

Any Indy Sponsor deal finances an acquisition through, (i) debt, (ii) contingent purchase price tools, and (iii) equity from investors or lenders.

Because most deals are over $2m EBITDA, the purchase price is often 5x-8x EBITDA.

(i) Debt. A combination of senior debt (50%-60% of PP), sometimes Mezz debt (10%-20%), and Seller financing (10%-20%). This debt often comes from SBIC lenders who make both debt and equity investments into the deal. On a minority of occasions, a lender will do a unitranche – a combo of Senior, Mezz, and Equity (sometimes in partnership with other lenders) to provide all the needed capital for the deal. Lenders will often take warrants (a right to equity at a future date).

There are some fantastic lenders in this market and some sharks – stay away from the sharks. Consider asking your lawyer (me) for recommendations or engaging a capital broker.

(ii) Contingent Purchase Price tools. The more a Sponsor can push to after closing the better. This includes promissory note, rollover, earnout, holdback, consulting agreement, and bonuses. This usually makes up 15%-30% of the purchase price.

(iii) Equity. Usually about 10%-20% of the PP comes from equity. I have done several deals where $0 of sponsor equity was used, but this requires a great deal of creativity. The Indy Sponsor usually raises from friends, family, and investors to cover this portion. Sometimes Lenders provide equity, but most want to see the sponsor bring equity. Sometimes equity investors fund a portion of the costs incurred between LOI and Closing.

Indy Sponsor Economics -

How does the Indy Sponsor get paid? 3 ways (i) Transaction Fees, (ii) Management Fees, and (iii) Carry.

(i) Transaction Fees. The Sponsor gets a transaction fee of 2%-3% of the purchase price of the deal to compensate the sponsor for closing the deal. Some lenders require the Sponsor to not take these fees out at closing, but roll them into the deal (I hate this – I’ll tell you why in another post). The Sponsor also gets fees if they execute an add-on, refinancing, or sale.

(ii) Management Fees. The acquired target pays management fees to the Sponsor. This is usually 5.5% of EBITDA, with a floor (ceiling is less popular). The floor is usually around $250k depending on deal size.

(iii) Carry. Because the Indy Sponsor usually does not invest equity, they do not own any percentage of the Fund – the investors do. However, the Sponsor has a right to Carry – a percentage of the profits from a sale after Investors have received their money back + a hurdle (negotiated return). These waterfalls can get very complex, but the usually (1) investors get money back, (2) preferred return/MOIC hurdle, (3) Sponsor catch up of up to the initial carry (usually, 20%), lastly, (4) a percentage to investors, and a percentage to Sponsor. (Often, there are more hurdles and Sponsor has a higher upside).

Sponsor Post-Closing Role

After closing a deal, a Sponsor is supposed to be moderately hands-off, however, most of the good Indy Sponsors are very hands-on – spending time on location and driving improvements.

from University of Kansas in Kansas City, MO, USA

in New York, NY, USA