Most People Raise Capital Before They Build. We Did the Opposite.

June 09, 2025

by a searcher from St. Cloud State University - Herberger Business School in Sheridan, WY 82801, USA

For those who’ve been following Verdira over the past few months, you know the kind of work we’ve been doing: structuring, negotiating, and surviving a high-friction healthcare acquisition in New York.

For those seeing this for the first time, well now you know.

We didn’t start by raising capital, but by proving the platform could hold under pressure.

1. $1.5M CPOM-restricted clinic under signed BTS, still ~150 days from close

2. MSO and PLLC structured, reviewed, and standing up under real diligence

3. 200+ pages of buyer-side contracts drafted

4. $7K FMV appraisal already paid

5. 400+ inbound applicants to our Fellowship before launch

6. AI-based sourcing engine fully built and ready for scale once capital finalizes

7. $150K verbally soft committed by aligned LPs

And that's exactly why we have those soft commitments.

Because none of this is theory.

Most people raise first and hope they can figure it out later.

But not us, we built first, and are proving it in real time, under pressure, and where it counts the most.

We’re now opening a $225K platform equity round to prepare the system for scale which includes activating fellow logins, CRM campaigns, and deal sourcing at volume.

We’ll then raise and deploy $5M in callable capital, one deal at a time.

This is not a fund and there's no blind pool.

We’ll acquire across CPOM and non-CPOM states, in verticals most buyers avoid and this platform round is the only one we’ll ever raise.

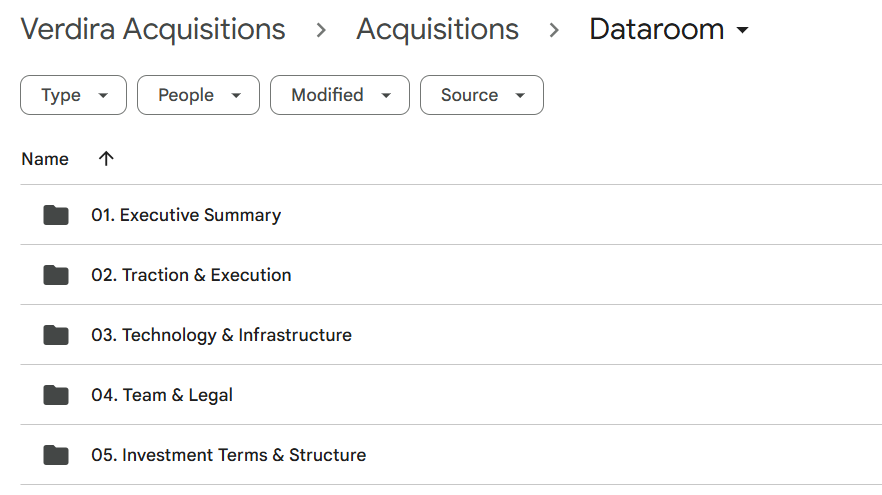

Data room infrastructure is currently staged in Google Drive (image attached).

Once finalized, we plan to use Verivend.com to manage LP access, execution control, and compliance visibility.

Verdira was incorporated in November 2024 and everything above (legal, operational, and technical) has been built since then.

We got here through structure, persistence, and yes, some luck, but luck does not build systems.

This came together because we have a sharp, disciplined, and aligned team, the kind you want around when a deal drags 200 days and still might not close.

We're not raising to see if this works. We're raising because it already does.

Best,

Marcus

Disclaimer:

This post is for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities. Any investment opportunity will be governed by formal legal documentation and applicable law.

For those who’ve been following Verdira over the past few months, you know the kind of work we’ve been doing: structuring, negotiating, and surviving a high-friction healthcare acquisition in New York.

For those seeing this for the first time, well now you know.

We didn’t start by raising capital, but by proving the platform could hold under pressure.

1. $1.5M CPOM-restricted clinic under signed BTS, still ~150 days from close

2. MSO and PLLC structured, reviewed, and standing up under real diligence

3. 200+ pages of buyer-side contracts drafted

4. $7K FMV appraisal already paid

5. 400+ inbound applicants to our Fellowship before launch

6. AI-based sourcing engine fully built and ready for scale once capital finalizes

7. $150K verbally soft committed by aligned LPs

And that's exactly why we have those soft commitments.

Because none of this is theory.

Most people raise first and hope they can figure it out later.

But not us, we built first, and are proving it in real time, under pressure, and where it counts the most.

We’re now opening a $225K platform equity round to prepare the system for scale which includes activating fellow logins, CRM campaigns, and deal sourcing at volume.

We’ll then raise and deploy $5M in callable capital, one deal at a time.

This is not a fund and there's no blind pool.

We’ll acquire across CPOM and non-CPOM states, in verticals most buyers avoid and this platform round is the only one we’ll ever raise.

Data room infrastructure is currently staged in Google Drive (image attached).

Once finalized, we plan to use Verivend.com to manage LP access, execution control, and compliance visibility.

Verdira was incorporated in November 2024 and everything above (legal, operational, and technical) has been built since then.

We got here through structure, persistence, and yes, some luck, but luck does not build systems.

This came together because we have a sharp, disciplined, and aligned team, the kind you want around when a deal drags 200 days and still might not close.

We're not raising to see if this works. We're raising because it already does.

Best,

Marcus

Disclaimer:

This post is for informational purposes only and does not constitute an offer to sell or a solicitation to buy securities. Any investment opportunity will be governed by formal legal documentation and applicable law.