Searchfunder Analysis: Distance to your Target

January 16, 2020

by an admin from Stanford University - Graduate School of Business in Honolulu, HI, USA

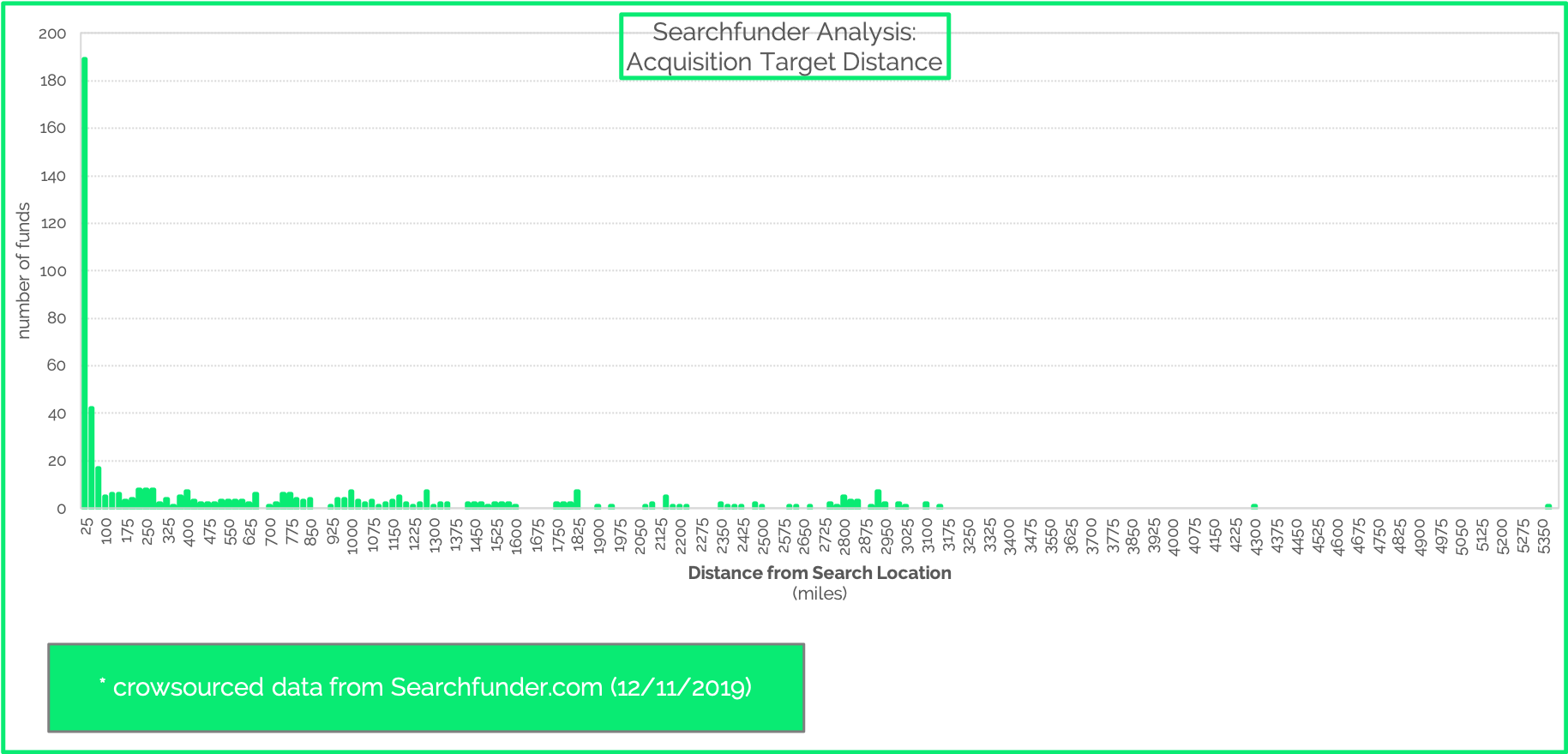

One of our members asked a question about choosing the location where they plan to conduct their search. Should they search from a location that was their geographic preference or from an airport hub that would make national travel more convenient? Based on our many conversations with searchers, our guts told us that most searchers find a company within 1.5 to 2 hours from their search location. However, we thought that it was time to take a harder look at our crowdsourced data.

30% of search funds find a target in the same area as their search location. The median distance for all known search acquisitions is 60 miles and within a 2 hour drive. The average is pulled up by a host of cross country acquisitions. (The longest distance comes in at a whopping 5350 miles). Thus, the average is 600 miles with a drive time within 9 hours . Essentially, 600 miles is the distance from Portland, Oregon to the California Bay Area or New York City to Charlotte -- both are about 2 hour flights. This indicates to us that the average location is likely to be found within a convenient day trip -- either by car or plane -- from the search location.

As the primary job of a searcher is to build relationships with business owners and properly vet target companies, it's likely these objectives are best accomplished when the target is within a convenient travel distance. Of course, luck can sometimes play into it, too. In our interview with ^redacted, he talked about how a business owner already happened to have a plane ticket to Mike's location for his kid's tournament.

The data is based on all known search fund acquisitions -- anywhere on the globe -- as of December 11, ###-###-#### Using Google Maps, we compared the search location with the acquisition location in terms of the driving distance and the drive time. We included locations like Hawaii in calculating the distance, but did not include them in the drive time calculation when there's no way to physically drive to the lovely island state.

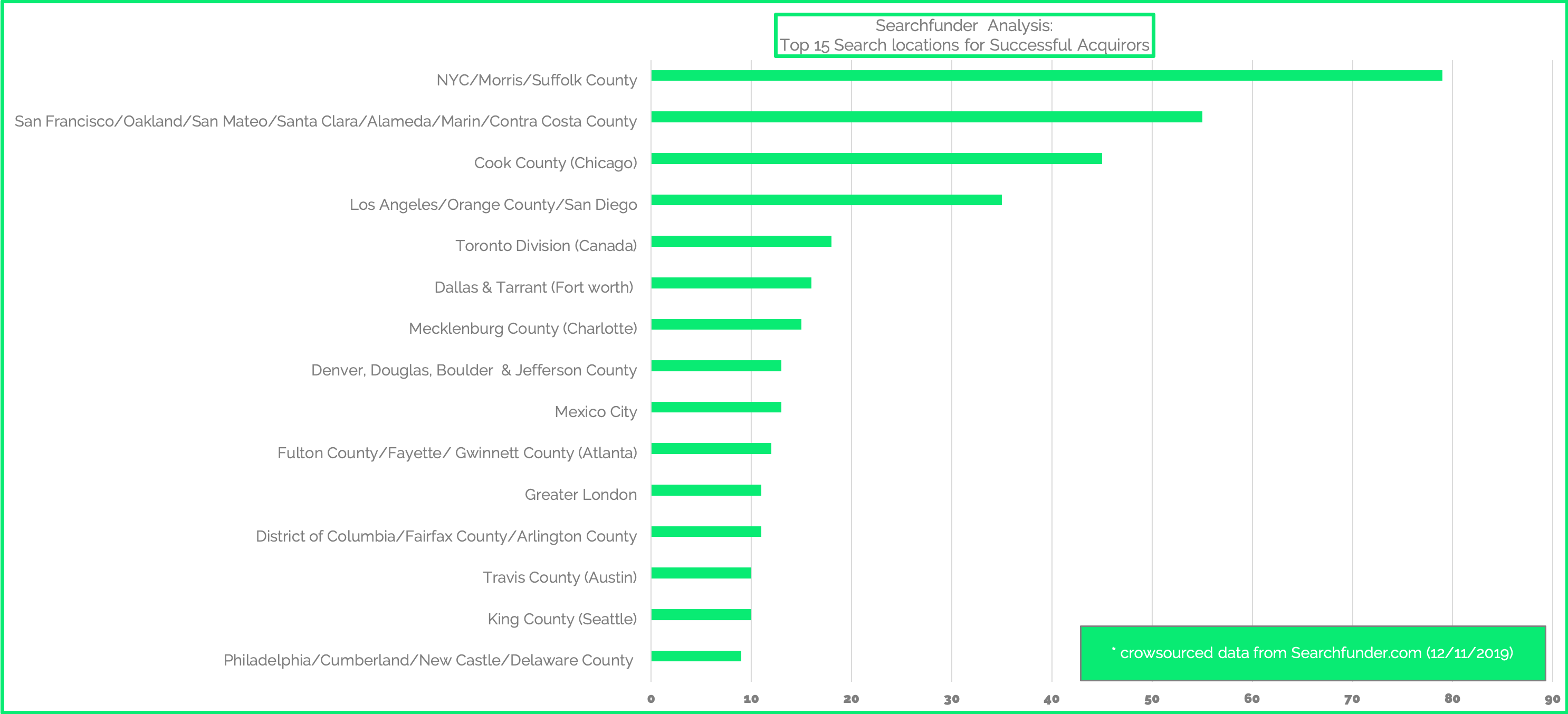

We further assessed the most popular places from where successful searchers conduct their search. The below chart includes only those search funds that have acquired a company. As you'll see, New York City with its 5 burroughs topped the list followed by the San Francisco Bay Area. The San Francisco Bay Area covers a fairly large swath from Santa Clara to Marin and Contra Costa Counties. However, San Francisco County by itself would land within the Top 5 of our list.

If only US cities were considered, then the Salt Lake/Provo, Minneapolis and Houston metropolitan areas would be ranked within the Top 15.

* crowdsourced* acquisition data collected as of 12/11/2019; subject to change.

from Harvard University in Omaha, NE, USA

Being in the search community for almost seven years now and speaking with many searchers, operators, and investors, I have believed that few searchers do true national searches. Everyone has preferences, and those preferences will get the highest amount of effort and attention. When I speak with potential searchers who say they’re doing a national search, I ask them if they have preferences. They usually do, and those preferences are also usually tied to family.

I remember when I was in the fundraising process, I told every potential investor that I was going to execute a regional search in the Great Plains. One prominent investor told me how he would not support that nor would most search fund investors. I had to do national. He proceeded to show me a map of the U.S. at night and all the concentrated light areas were on the coasts and not the Midwest. He said this map shows why a nationally focused searcher would likely be more successful than a regional searcher. But that’s not what I saw. What I saw was him pointing out that I should focus my search on the coasts.

Location matters, and I believe searchers should give serious consideration to the location of a company. I took my wife to every site visit I did. While I was meeting with the owner, she would drive the area and speak to locals. If she wasn’t sold on the location, that deal was off my list, and my investors were supportive of that condition. If you’re miserable where you live, how long are you really going to want to stay there? Now add in a partner and kids.

Read the HBS case on Castronics. Highly successful search from start to finish, but it was in an undesirable location, and those owners said they struggled with that (and wouldn’t live there—they commuted great distances).

from Michigan State University in Davis, CA, USA

Does anyone know if any data showing how outcomes vary based on search criteria (i.e., industry-focused vs geographically focused)? In a vacuum, it would seem that a truly national industry-focused search has a higher probability of a successful outcome, but the data seems to imply that few people actually execute a true national search.