Seller note

September 08, 2025

by a lender from University of Arizona in Raleigh, NC, USA

Ever had a deal fall apart at the finish line because the seller didn’t understand subordination? You’re not alone.

In business acquisitions, it’s not unusual for sellers to carry a portion of the purchase price via a Seller Note. It’s a helpful tool that reduces bank exposure, lowers buyer’s cash outlay, and improves deal feasibility.

But if SBA financing is involved, that Seller Note becomes part of a more complex equation.

Here’s what often gets missed:

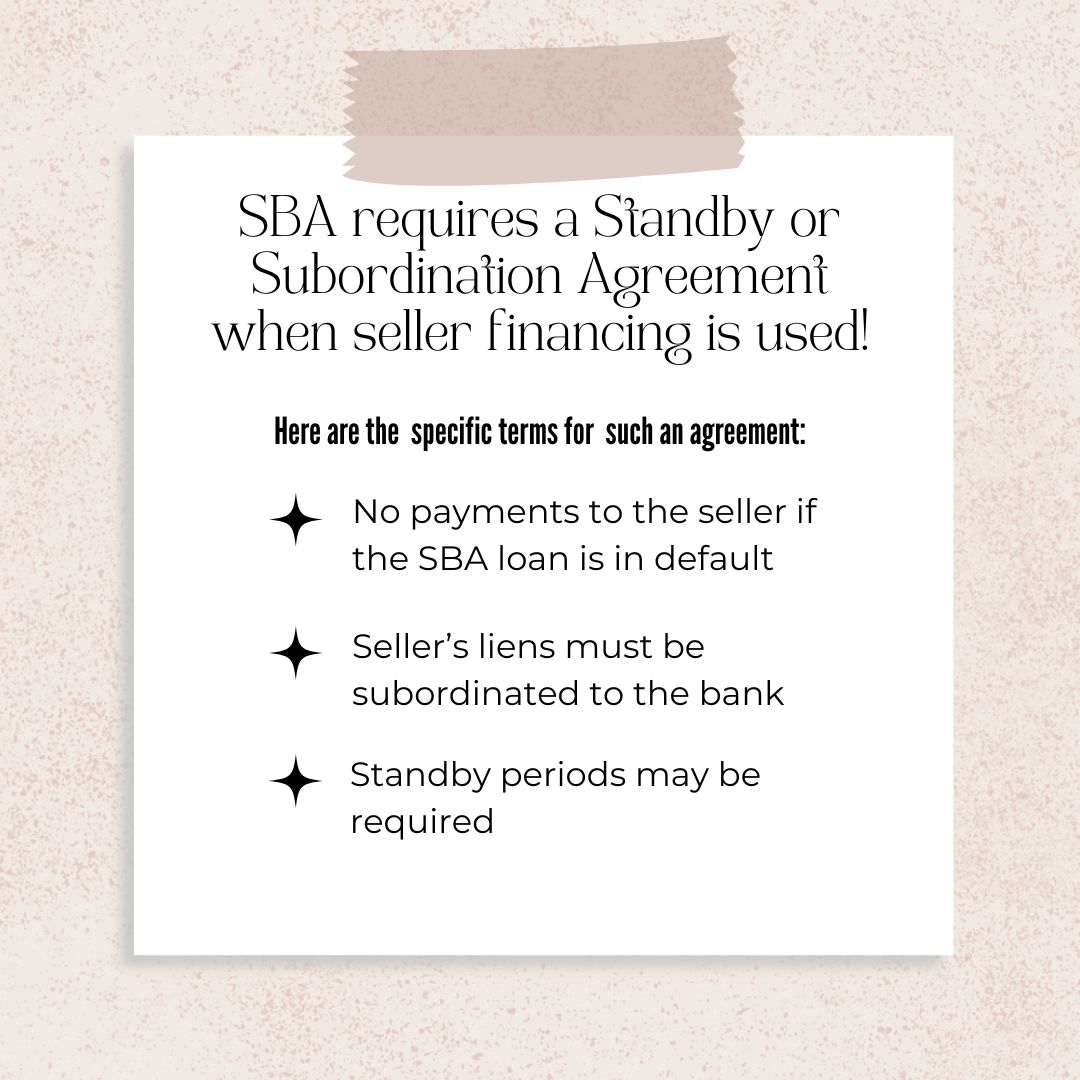

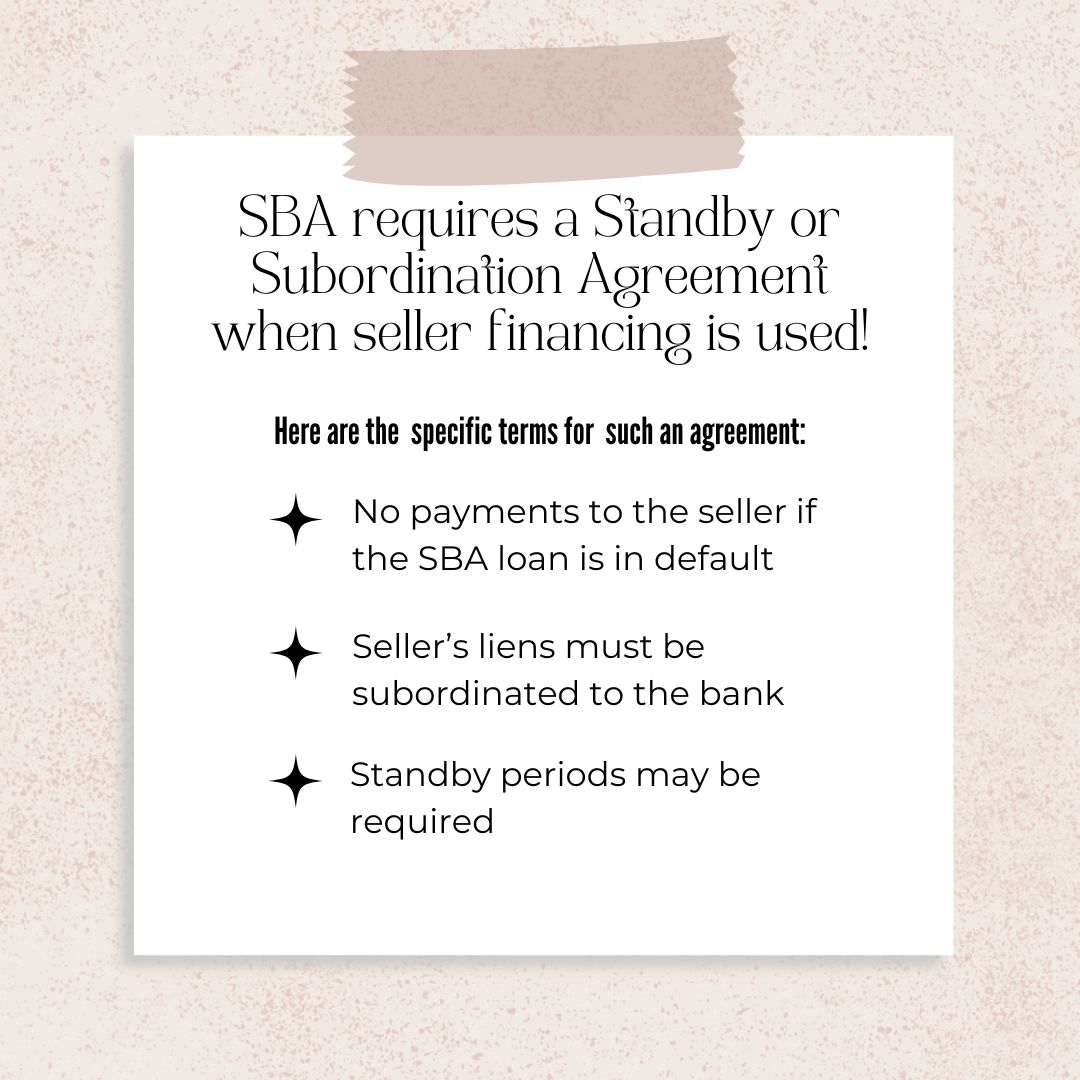

SBA requires a Standby or Subordination Agreement when seller financing is used. And this agreement comes with very specific terms:

* No payments to the seller if the SBA loan is in default

* Seller’s liens must be subordinated to the bank’s

* Standby periods may be required

* If the Seller Note is used as part of the buyer’s equity injection, it must be on full standby for the life of the loan

This often comes up late in the game, sometimes right before closing. When a seller finds out they can’t collect payments for years, or that their lien comes second, the deal can stall or fall apart entirely.

Set expectations early.

Share the Standby Agreement with the seller (and their counsel) as early in the process as possible to avoid closing table surprises, delays, or worse deals blowing up.

Have you seen this derail a deal before? Let’s talk lessons learned.

from University of Michigan in Detroit, MI, USA

from University of Arizona in Raleigh, NC, USA