Tax burden... am I doing this right?

October 17, 2020

by a searcher from Full Sail University in Milwaukee, WI, USA

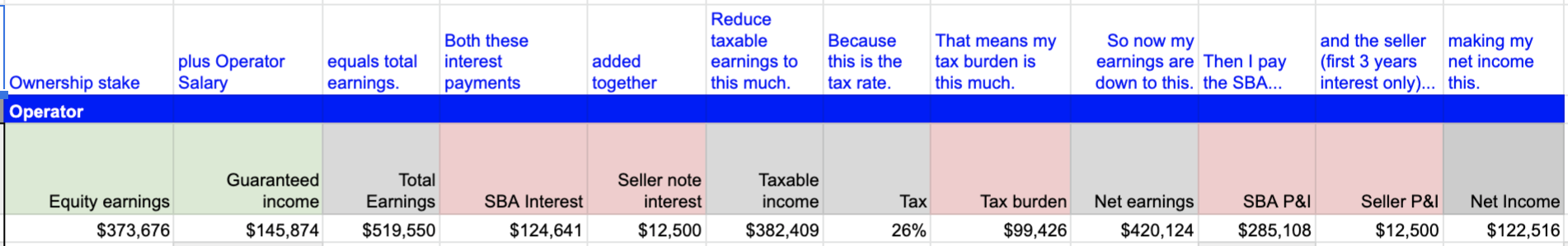

Trying to answer a sellers counter to my LOI, and want to make sure I'm really solid on how the taxes would work since margins are getting thin. Does this read correctly? Labeled across the top for help interpreting.

from Harvard University

from Harvard University in Plano, TX, USA

In the first 3 years, since the seller note is interest only, that means the principal portion is $0. For the SBA loan, you will need to split out the interest and principal portions. You can use the IPMT and PPMT formulas in Excel.