Trump Tariffs against SMEs in the US

April 09, 2025

by a searcher from IESE Business School in Barcelona, Provincia de Barcelona, España

The recent implementation of a 104% tariff on Chinese imports by the U.S. administration raises significant concerns regarding its impact on American consumers and the broader economy. Economists estimate that such tariffs could increase consumer price inflation by approximately 0.35 percentage points, exacerbating existing inflationary pressures.

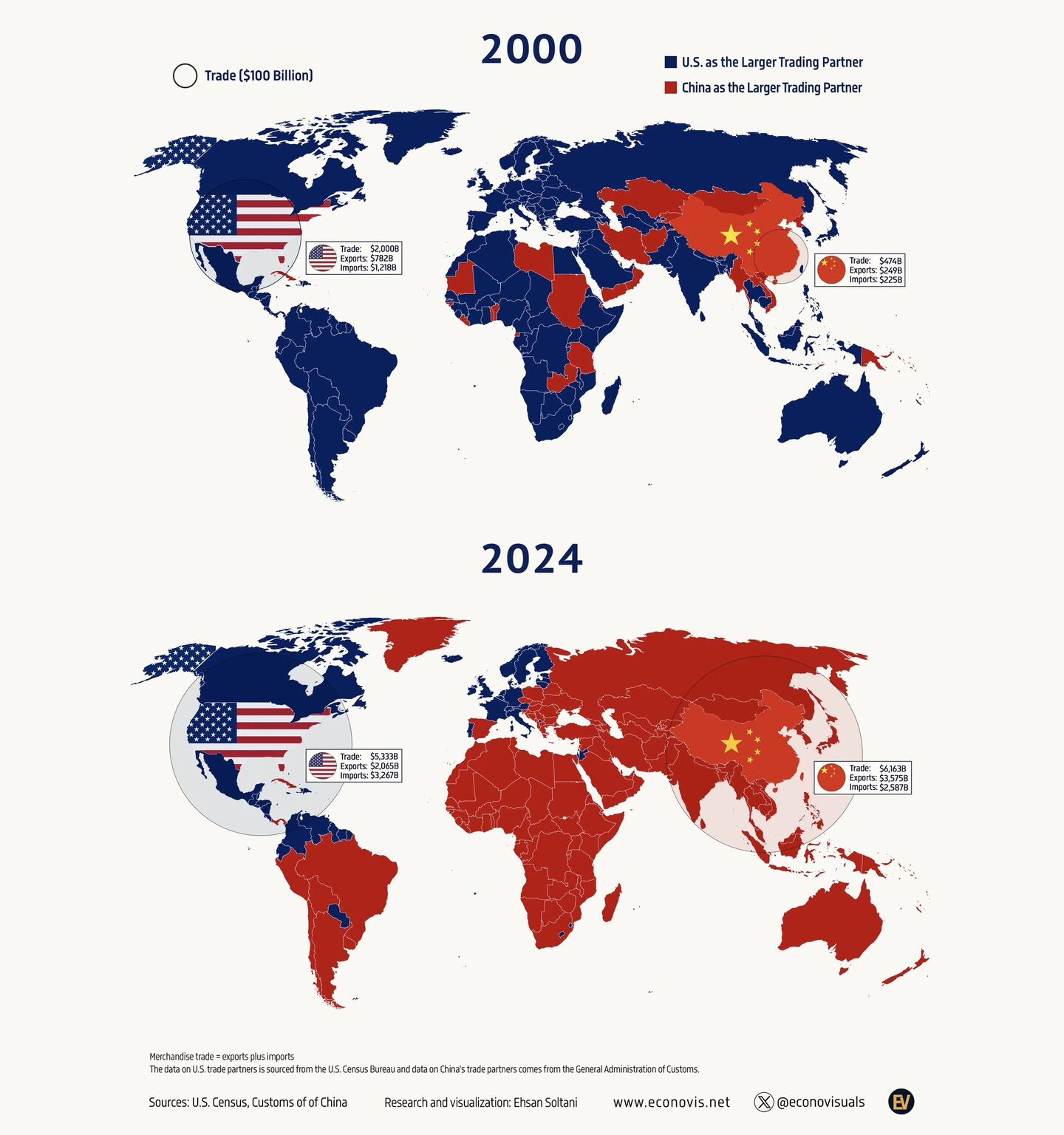

Furthermore, these tariffs have led to volatility in financial markets, with U.S. Treasuries and the dollar experiencing declines as investors anticipate potential economic slowdowns. The escalation in trade tensions has also prompted China to retaliate with its tariffs, further straining bilateral trade relations.

In this context, the strategy of imposing such substantial tariffs appears to conflict to strengthen the U.S. economy. The potential for increased consumer costs, coupled with retaliatory measures from trading partners, may ultimately undermine the competitiveness of American industries and reduce the appeal of the U.S. as a trading partner. This approach could lead to a decrease in bilateral trade over time, challenging the goal of economic revitalization.

An often-overlooked consequence of these escalating tariffs is their disproportionate impact on U.S. SMEs. Unlike large multinationals, SMEs typically operate with tighter margins and limited leverage in their supply chains. Many rely on Chinese inputs, whether components, machinery, or finished goods, to remain competitive.

These new tariffs, applied broadly across sectors, not only increase input costs but also inject uncertainty into sourcing decisions and financial planning. As a result, SMEs face tougher pricing decisions, potential delays in production, and reduced competitiveness both domestically and abroad. In the long run, these pressures risk stifling entrepreneurship and innovation, pillars of American economic resilience. For searchers in the US, this is a topic to consider for the future and to keep track in the upcoming months.

from Southern Methodist University in Fort Lauderdale, FL, USA

from Clemson University in Raleigh, NC, USA